For instance, EPS has a P/E of 16.2 while the S&P 500 shows a P/E of 17.5. EZM has a P/E of 16.7, compared to the S&P MidCap 400 Index’s P/E of 19.8.

WisdomTree also offers a suite of dividend-weighted ETFs that weight companies on the aggregate cash dividends they are projected to pay in the coming year based on the most recently declared dividend per share, including the WisdomTree LargeCap Dividend Fund (NYSEArca: DLN), WisdomTree MidCap Dividend Fund (NYSEArca: DON) and WisdomTree SmallCap Dividend Fund (NYSEArca: DES). [Some Strategic Beta ETFs Shine Bright]

“Tilting portfolio weights toward high-yielding stocks has historically ehanced total returns,” Siracusano added.

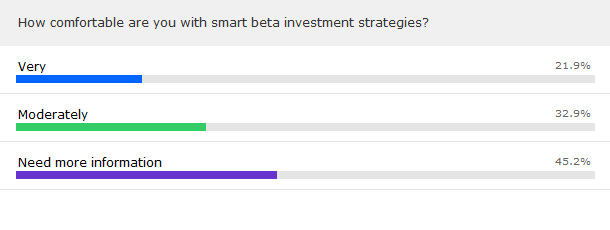

Smart-beta strategies have been gaining popularity, with more investors considering alternative index-based ETF investments, as the following survey on the webcast revealed. However, there is still need for greater education to help investors understand how these strategies work and how they fit into an investment portfolio. [Smart Beta ETFs Grow, Gain Naysayers]

Financial advisors who are interested in learning more about smart-beta ETFs can listen to the webcast here on demand.

Financial advisors who are interested in learning more about smart-beta ETFs can listen to the webcast here on demand.