The two most popular comments about the housing recovery are that it’s weak and the reason why GDP growth is so slow. There is some truth to both of these — the problem is new single family homes. Looking across housing, one sees surprisingly strong construction of apartments, progress in working through the backlog of foreclosures as banks sell real estate they don’t want to own and increasing sales of existing homes. Prices of existing single family homes, helped by low mortgage rates and improved consumer confidence rose 12.5% in the year ending in March.

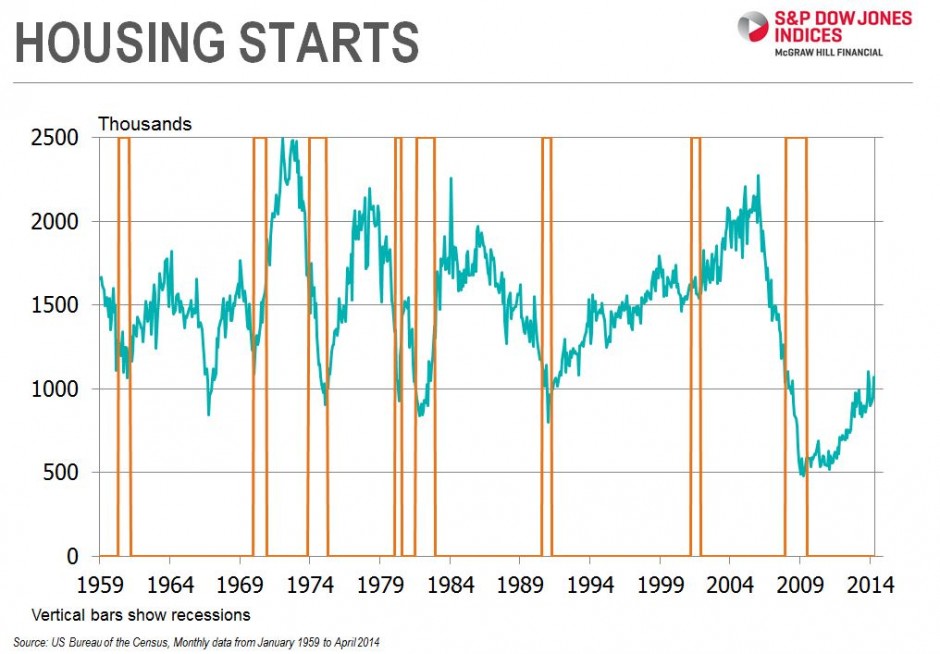

All this is positive, but without growth in new single family homes, GDP growth lags. New construction, not sales of existing homes, is what generates jobs and adds to GDP growth. In most recoveries, the share of single family homes in housing starts (see first chart) surges. This time, there was an initial surge followed by a sharp drop. While apartment construction is up, it has not made up the difference in housing starts which continue at about two-thirds the level we should be seeing.

There are lots of reasons, but no one big reason for the softness. Mortgages rates are low, but banks are still reticent about loans. Many potential home buyers may have little borrowing capacity due to recent car purchases or student debts. The New York Times noted that the number of foreclosed homes sold by banks has been substantially greater than the number of new homes sold by builders in recent years. While these factors will be resolved over time, there are questions about demographic shifts that could mean less building of single homes in the future. Will people prefer renting to buying because they expect their employment to change more often or will their preferences shift to urban living from suburbia? As the baby boomers begin to retire, will they ignore retirement communities and head to new downtowns in revived cities? This may seem farfetched to some observers. However, suburbia and universal car ownership didn’t really exist before the Second World War, so single family homes could change again.

This article was written by David Blitzer, chairman of the index committee, S&P Dow Jones Indices.

© S&P Dow Jones Indices LLC 2013. Indexology® is a trademark of S&P Dow Jones Indices LLC (SPDJI). S&P® is a trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a trademark of Dow Jones Trademark Holdings LLC, and those marks have been licensed to SPDJI. This material is reproduced with the prior written consent of SPDJI. For more information on SPDJI, visit http://www.spdji.com.