The coming week will provide Europeans with a chance to vote in the 2014 EU parliament elections. Nationally and internationally, the contest is viewed as somewhat moot; the majority across the EU will most likely not even vote.

But whilst voters in the EU elections are not voting for members of the ECB or its president Mario Draghi, the European central bank IS directly governed by the laws of the EU parliament. With laws defining a financial transaction tax, bank regulation and a potential banking union all on the immediate agenda for the EU, the outcome may be more important than the minimal degree a low turnout and sparse media coverage implies.

At the time of the last elections (held between 4 and 7 June 2009), the EU exhorted citizens to vote with campaigns with titles such as “How much should we tame financial markets?”. Since then, in price terms, the S&P Europe 350 index of large-cap stocks is up by over two thirds. And, whilst the markets were not “tamed” entirely, volatility has certainly come down:

S&P Europe 350 price return and volatility, May 2009 – May 2014

Source: S&P Dow Jones Indices, May 2014. Charts are provided for illustrative purposes only. Past performance is no guarantee of future results.

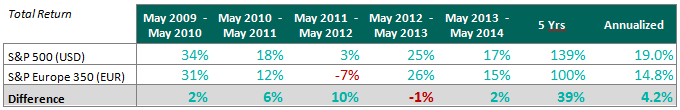

Most equity investors would not be disappointed with such returns – including the effects of dividends before tax, the gross total return of the S&P Europe 350 was 100% – but investing is a relative game. If you had decamped to the U.S. markets and the S&P 500 in particular, as many did during the Eurozone crisis, you would have done better.

Source: S&P Dow Jones Indices, May 2014. Tables are provided for illustrative purposes only. Past performance is no guarantee of future results.