2. The unprecedented quantitative easing caused a risk-on/risk-off environment where either the stimulus worked or didn’t work. If a commodity investor did not feel the insurance risk premium was high enough to supply to the producer, no investment was made. Without the supply of insurance, the incentive for producers diminished and the volatility of prices increased. This proved too much risk for the investors to bear that drove the game of risk transfer back to the producers. Now, not only is backwardation back from the diminished inventories, but the result of that in conjunction with the tapering of quantitative easing, is that diversification is back.

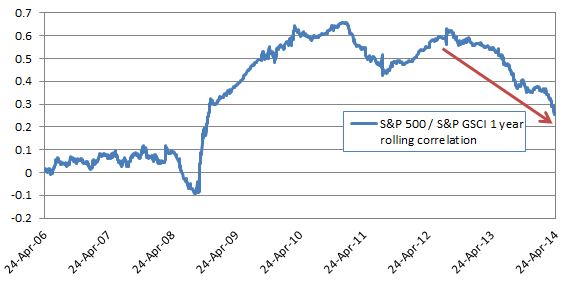

Notice in the charts above that both correlation of commodities to each other and to other asset classes has fallen to precrisis levels of about 0.2, indicating little movement together with stocks and bonds and little movement together with each other. This makes commodities, once again, an asset class to provide diversification, and institutional investors are taking notice.

Last, the key question is… Will this diversification continue?

Based on the correlation patterns of the S&P 500 to the S&P GSCI, there is a compelling case this will continue.

The 12 month correlation between the S&P 500 and S&P GSCI at 0.26 is lower than at any point since November 2008 and heading down fast. Shorter term measures such as the 90 day and 30 day correlation are even lower at 0.17 and 0.01, suggesting that as correlation “catches up” with the history, it will head down further.

Special thanks to my colleague, Timothy Edwards, who helped with this.

This article was written by Jodie Gunzberg, global head of commodities, for S&P Dow Jones Indices.

© S&P Dow Jones Indices LLC 2013. Indexology® is a trademark of S&P Dow Jones Indices LLC (SPDJI). S&P® is a trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a trademark of Dow Jones Trademark Holdings LLC, and those marks have been licensed to SPDJI. This material is reproduced with the prior written consent of SPDJI. For more information on SPDJI, visit http://www.spdji.com.