Still, there is a far more potent reason for gold to make a short-term run than the emerging market connection. The debt ceiling debacle of 2011 went a long way towards creating a stock market correction that year; euro-zone woes then exacerbated fears of stock ownership. Indeed, the May-October swoon rocked U.S. stocks, as the Dow Industrials logged a high-to-low closing decline of approximately -19.9%, Meanwhile, gold futures gained 25%+ over the same time frame.

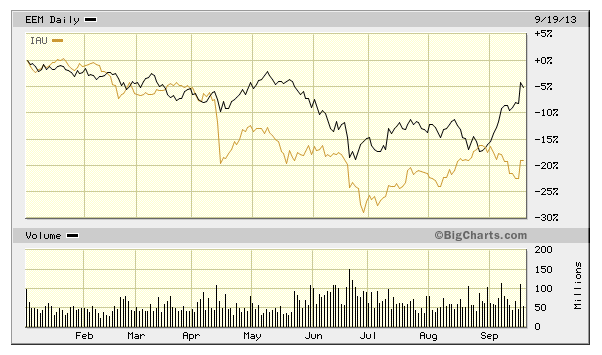

Gold, then, may or may not reclaim a throne as a currency proxy. On the flip side, it is maintaining its association with the emerging market growth (or lack thereof) story. And, more notably, it is keeping its place as a shelter from severe political storms.

If the U.S. budget debate and debt ceiling negotiations result in a lengthy shutdown of the U.S. government, if the rhetoric heats up to a boiling point where resolution appears elusive, funds like iShares Gold (GLD), PowerShares DB Precious Metals (DBP) and iShares Silver Trust (SLV) will benefit. If a deal is struck in much the same way that the fiscal cliff was resolved, stocks may not suffer much in the way of a pullback and precious metal performance will likely rely on data coming out of emerging economies.

Gary Gordon is president of Pacific Park Financial, Inc.