Granted, long treasury bonds as well as extended duration treasury bond ETFs could not buy a break since the Fed began hinting about slowing its bond purchases back in May. Even the threat of a military strike on Syria failed to lift income-oriented ETFs. With the Bureau of Labor Statistics (BLS) presenting its findings for August, though, funds like iShares 20 Year Treasury (TLT) smelled the possibility of a reversal.

Perhaps ironically, the increasing unlikelihood of meaningful changes to Fed policy on September 18 is keeping stock investors engaged. (At least for now.) And why not? Quantitative easing (QE) may be subject to the law of diminishing returns, but returns there still are. Even the highest estimate of Fed “de facto tightening” of its QE3 policy is to slow the bond buying from $85 billion down to $65 billion; that’s still equivalent to the stimulus associated with QE2 — the same stimulus that is credited with 2nd half 2010 gains as well as 1st have 2011 success.

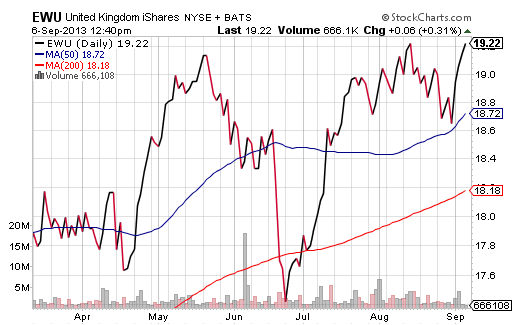

Of course, before getting giddy about the strong possibility of stateside stimulus, I must emphasize a preference for “steady-as-she-goes” foreign stimulus. For example, the Bank of England (BOE) has been making it real easy to like iShares United Kingdom (EWU).

Gary Gordon is president of Pacific Park Financial, Inc.