Roughly two-thirds (66%) of the municipal marketplace has assigned revenues that are an identifiable source of debt repayment – that is, they are supported by specific project revenues, rather than by a variety of unassigned tax sources as is the case with general obligation bonds. This reduces the likelihood of municipal bond defaults.

Isolated Areas of Vulnerability

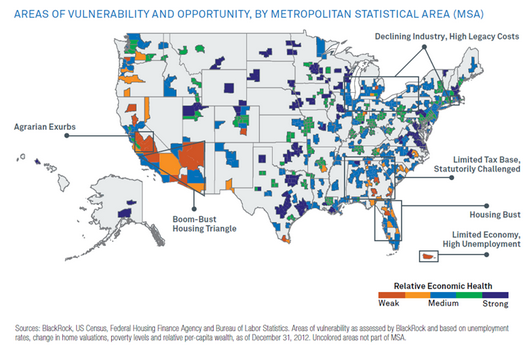

To those who see distress in the muni market as rampant, we would offer the map below. Trouble spots exist, but we see many more areas of opportunity (note the blues and greens).

We think these images speak for themselves, and rise above the hubbub. Enough said … for now.

Peter Hayes, Managing Director, is head of BlackRock’s Municipal Bonds Group.