Absent a huge escalation, though, the trend in oil is not a reflection of strength in demand for the commodity itself. China’s oil imports peaked early in 2013. Meanwhile, Morgan Stanley estimates that seasonal trends will contribute to a reduction in stateside demand in the months ahead.

If one’s premise is that there will be a monstrous event in the Strait of Hormuz where one-fifth of the world’s oil passes through, then one might consider an investment in an oil ETF/ETN. A case might also be made on an appreciation of technical strength alone. On the flip side, not only is demand likely to weaken, but supply disruptions outside of “war games” are beginning to dissipate. More oil is flowing out of Libya as labor disputes begin to settle; meanwhile, disturbances to Canadian production and distribution are nearly over as well.

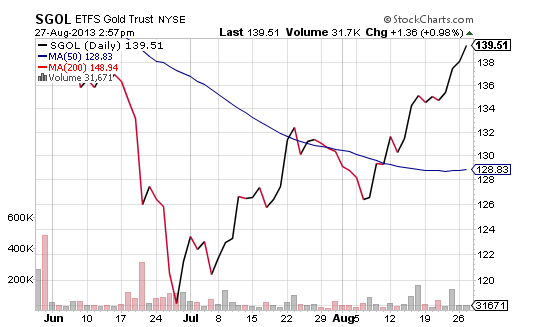

While it is difficult to speculate on what may or may not occur in the Persian Gulf, I am more likely to favor “yellow gold” over “black gold.” In my opinion, there are more reasons — fundamental, technical, geopolitical, monetary policy – to favor a physically-backed gold ETF like ETFs Physical Swiss Gold (SGOL) than to join the bullish rush to oil.

Gary Gordon is president of Pacific Park Financial, Inc.