HIGHER YIELDS

Historically, local-currency emerging market bonds offered significantly higher yields than the government or corporate bonds of developed countries. For example, the Barclays Global Emerging Markets Local Currency Diversified Index maintains a weighted average yield to maturity of 4.99% vs. 1.50% for the Barclays Global Treasury ex-US Index and 1.71% for the Barclays Global Aggregate (Figure 4). International developed country income indexes don’t yield as much as their emerging market counterparts. This may be attractive for yield-sensitive investors who can potentially tolerate some volatility.

Source: Barclays Live, SSgA, as of 12/31/2012.

Past performance is not a guarantee of future results.

FOREIGN CURRENCY APPRECIATION

For US-based investors, changes in foreign exchange rates can account for a significant portion of their returns from international investing. This is particularly true for fixed income investments. For example, in 2009, emerging market currency appreciation relative to the US dollar accounted for almost 57% of total returns for the Barclays EM Local Currency Government Bond Index. When the dollar weakens versus a local currency, the prices of local-currency bonds rise—and vice versa.

Investors are increasingly attracted to opportunities for tactical investing in emerging market debt to take advantage of trends that may push local currencies higher. These trends include the following:

- Strong economic growth, especially when contrasted with developed countries’ growth

- Rising inflation and interest rates in emerging market countries, which are ahead of developed countries in this respect

- Pressure on emerging market countries to allow their currencies to strengthen

EMERGING MARKET BOND LANDSCAPE

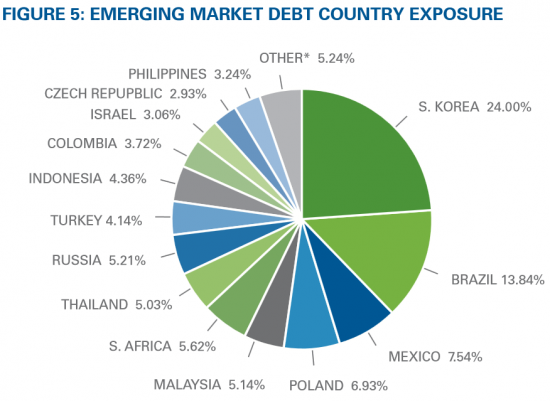

The emerging market local currency debt landscape encompasses more than 415 issues across 19 countries, each with their own respective currency. Not surprisingly, the countries further along the path toward being classified as developed tend to issue larger amounts of debt which leads to an outsize presence in standard market value weighted indices. For example, South Korea is a country that remains on the fringes of both developed and emerging classifications. In fact, S&P and MSCI offer contrasting views, with S&P elevating South Korea to developed status in 2008 while MSCI continues to keep the option to graduate under review. With this in mind, it comes as no surprise that with a local currency government bond market of more than $406 billion, South Korea’s debt issuance is 173% higher than the next closest country. Furthermore, at the lower end of the spectrum are countries like Croatia, whose government debt market is just over $4 billion.

Source: Barclays Live, SSgA, as of 12/31/2012. Based on Barclays EM Local Currency

Government Debt Index. *Other includes the following country weights: Egypt 1.71%, Hungary 2.09%, Peru 0.78%, Chile 0.41%, Croatia 0.26%.

With the continued expansion of local currency emerging market debt as both a strategic and tactical asset class, comes the subsequent demand for investable indices. In an effort to ensure country and currency diversification and limit the dominance of any one country or currency, many of these indices impose maximum weights for each category. In addition, illiquidity and limited access to certain local debt markets erects another prohibitive barrier. Index providers have addressed this by implementing liquidity or minimum debt outstanding minimums.

SPDR® BARCLAYS EMERGING MARKETS LOCAL BOND ETF [EBND]

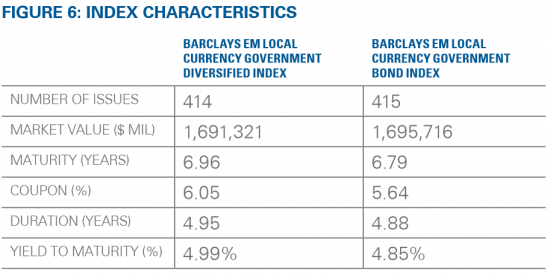

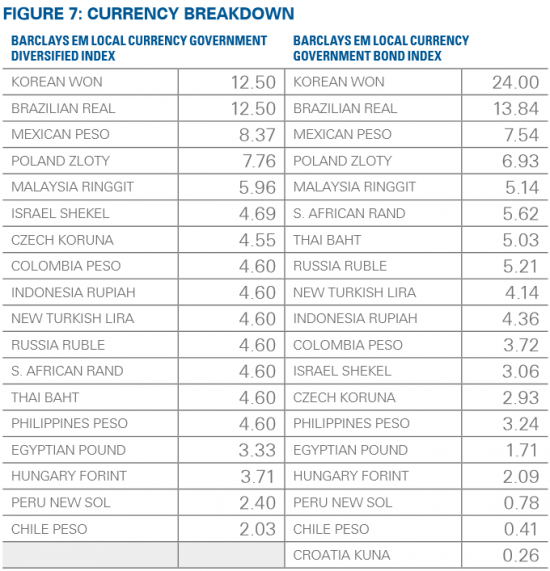

As a leader in global fixed income and a pioneer in international debt indexes, Barclays is among the most respected and widely used providers of fixed income benchmarks. Seeking to create an investable emerging market debt index Barclays created the Barclays EM Local Currency Government Diversified Index, which the SPDR Barclays Emerging Markets Local Bond ETF [EBND] seeks to track. The Index represents a subset of the Barclays EM Local Currency Government Debt Index. The most notable difference from the broader Index is that individual country weights are capped at 12.5%. This limits the influence of South Korea and the Won currency and redistributes the excess exposure, providing a greater level of country and currency diversification. Despite the country caps and liquidity screens, the Barclays EM Local Currency Government Diversified Index is largely representative of its broader parent (Figures 6 and 7).

Source: Barclays Live, SSgA, as of 12/31/2012.

Past performance is not a guarantee of future results.

Source: Barclays Live, SSgA, as of 12/31/2012.

CONCLUSION

Its is likely that investors will reflect back on 2008-2010 as a time when emerging market local currency debt exited its infancy stages and solidified a place as a ubiquitous asset class in investor portfolios. If the 96% growth over the last four years serves as an indicator, it appears as though emerging market debt is following the same trajectory emerging market equities left in their wake with more than 267% expansion in market capitalization values over the last ten years. Couple this growth with prospects for increasing values of emerging market currency valuations abroad and a natural hedge for dollar denominated assets within a portfolio and the outlook only broadens. In our view, the SPDR Barclays Emerging Markets Local Bond ETF [EBND] provides an efficient and cost effective vehicle for capitalizing on this projected growth.

WHO SHOULD INVEST?

- INVESTORS SEEKING TO BENEFIT FROM EMERGING MARKET ECONOMIC GROWTH: Emerging market growth has the potential to drive up the value of local currencies and the related bonds. It also makes the creditworthiness of emerging market bonds compare favorably with that of some developed countries’ bonds.

- INVESTORS SEEKING YIELD: Emerging market local-currency bonds may offer yields significantly higher than developed market government debt, although investors must be able to tolerate volatility.

- INVESTORS IN EMERGING MARKET STOCKS WHO SEEK A COMPLEMENTARY EXPOSURE IN BONDS: Emerging market bonds may partly offset the negative impact of dollar appreciation on the stocks of exporters in emerging markets.

- TACTICAL INVESTORS WHO PERCEIVE A SHORT-TERM OPPORTUNITY: The ETF allows investors to invest precisely in this kind of bond

when they think it’s poised to outperform.

RISKS OF EMERGING MARKET LOCAL-CURRENCY BONDS

To earn the benefits of diversification, investors must typically take more risk. Emerging market local-currency bonds present some risks that aren’t typical with US government bonds. These include the following:

- The bonds’ accessibility and liquidity can change rapidly. This is partly because fewer large benchmark issues are available than in developed markets. Emerging markets have historically seen rapid reductions in trading liquidity during market crises. As a result, volatility has the potential to be high.

- Foreign countries may impose currency controls or change bonds’ tax status, both of which could make profitable investments more challenging. Governments may restrict the inflow or outflow of currency. They may also create or raise taxes associated with investments.

- Emerging market countries’ political risks may be more pronounced than those of the US and developed market countries. Politics may make countries less willing to pay.

David Mazza is vice president and head of ETF investment strategy, Americas, for State Street Global Advisors, which manages the SPDR ETFs.