“One of the catalysts that can take the euro a lot higher would be a big sell-off in the U.S. Dollar Index. Among other reasons to be cautious here in the dollar is the unsustainable amount of bulls out there in this space,” he added.

The euro ETF fell Thursday after the European Central Bank and ECB President Mario Draghi disappointed investors who were looking for more stimulus.

“People were expecting coordinated measures to ease conditions in Europe, and it was largely a disappointment,” said Aroop Chatterjee, chief foreign-exchange quantitative strategist at Barclays, in a Dow Jones Newswires report. “It showed how the ECB isn’t going to do anything until governments get their acts together.”

FXE is down about 8% for the trailing three months on Eurozone debt worries. Conversely, PowerShares DB US Dollar Index Bullish Fund (NYSEArca: UUP) is up about 5%.

CurrencyShares Euro Trust

Chart source: MarketWatch

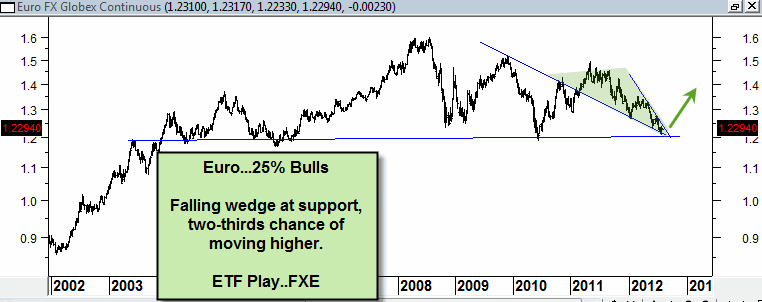

Euro

Chart source: Kimble Charting Solutions