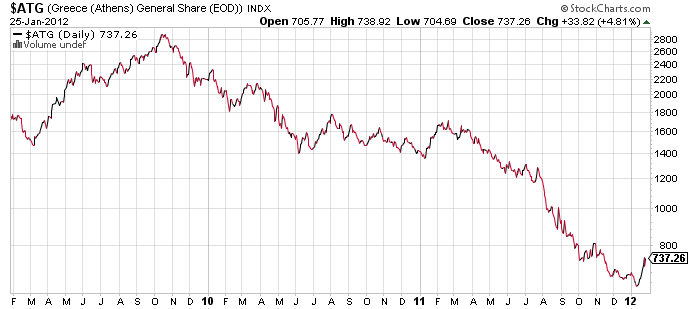

“That’s a massive correction and the outlook for Greece remains grim,” del Ama said. “But it begs the question if there could be an opportunity to buy at these valuations.”

Morningstar analyst Robert Goldsborough expects a bumpy ride for the Greece ETF, saying it is more suitable as a trading vehicle than a long-term investment. The country has required several financial bailouts, and is trying to implement austerity measures and stop tax evasion.

“With Greece’s equity markets down some 90% from their peak, investors may find the share prices of this ETF’s underlying holdings to be overdone,” Goldsborough wrote in a profile of Global X FTSE Greece 20 ETF.

“There may be more pain ahead, if the Eurozone collapses or if Greece’s leaders are not able to get their financial house in order,” he added. “Continued strife and demonstrations may scare away tourists who are an important part of Greece’s economy.”

Global X FTSE Greece 20 ETF

Greece General Share Index