“With unemployment still high and wages growing so slowly that hourly workers are losing purchasing power at the fastest rate in 20 years, you may be wondering where consumers are getting the money to buy new cars or the latest iPhone,” he said. In fact, better-than-expected retail spending is “being supported by lower savings and by help from the government.”

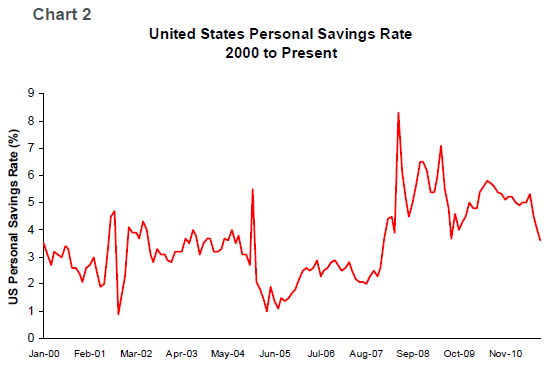

The strategist noted that the U.S. savings rate is dropping again, falling to 3.6% in September, the lowest rate since 2007. Meanwhile, government transfer payments — such as Social Security, unemployment and disability payments — have jumped in recent years.

“Saving less can continue for a while longer, but not indefinitely. More importantly, the U.S. consumer’s reliance on transfer payments shows why investors should pay particular attention to any budget cuts that come out of the Congressional super committee negotiations,” Koesterich wrote. “Any near-term tax increases or reductions in transfer payments would hit consumers at a difficult time and could act as a drag on an already feeble expansion.”