In these tough economic times, retailers have been tripping all over themselves to offer values and bargains to consumers. To get exposure to these companies, look no further than retail exchange traded funds (ETFs).

Dollar stores have shown the biggest spike in shopper visits over the last year out of all the retailers that sell basic consumer goods, according to market data. Research shows that people can afford small amounts of cheap items over the expensive larger shopping trips these days. [Consumer Sentiment Keeps ETFs Flat.]

Stephanie Clifford for The New York Times reports that manufacturers are also getting in the game by putting together more affordable versions of products available at dollar stores in order to challenge them.

The recession may be over, but household budgets are in lockdown mode. One sign of this: dollar stores report sales upticks at the start of the month, when their customers get benefit checks and paychecks. Later in the month, sales fall off. [Is It Time To Shop Retail ETFs?]

Two ETFs that give exposure to the stores that cater to the bargain hunters and the cash-strapped:

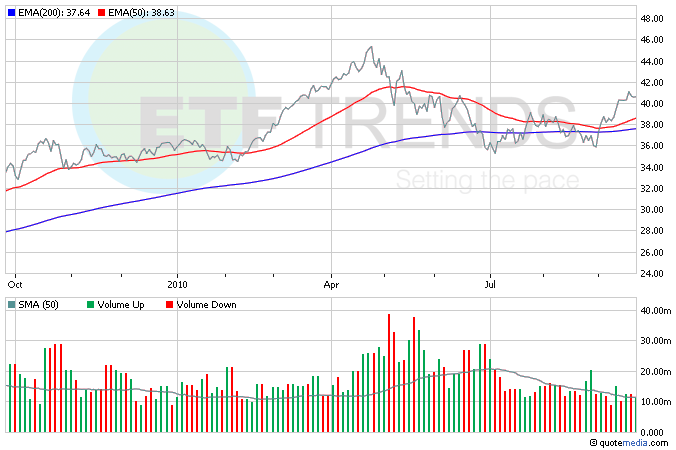

- PowerShares Dynamic Retail (NYSEArca: PMR) holds bargain and value retailers such as Dollar General (4.6%), Rent-a-Center (2.8%), Ross (2.7%) and Family Dollar (2.6%)

- SPDR S&P Retail (NYSEArca: XRT) holds bargain and value retailers such as Priceline (2.8%), Expedia (2%), CarMax (1.8%), Dollar Tree (1.7%), Family Dollar (1.7%) and more.

Tisha Guerrero contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.