Despite a retail sales gain in August that bested expectations, stocks and exchange traded funds (ETFs) kicked off the morning in a funk, edging down about as much as 40 points before paring losses to turn flat.

According to the ETF Analyzer, metals ETFs are moving higher this morning, led by ETFS Physical Palladium Shares (NYSEArca: PALL), which is up more than 3%. The gains can largely be attributed to auto production in China, which jumped by one-third between 2007 and 2009 and surpassed the United States in 2008.

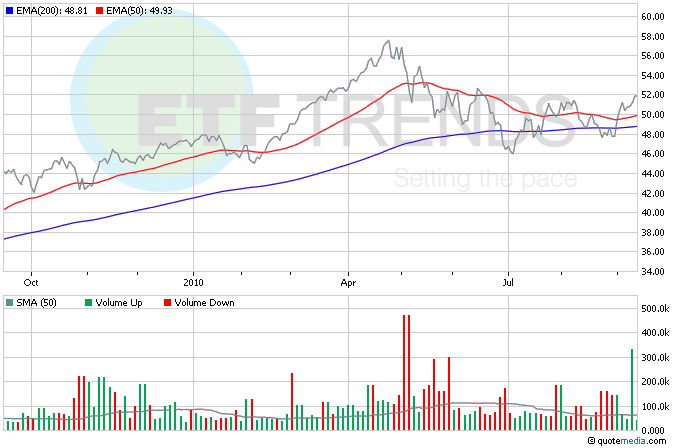

Europe’s waning economy suffered another blow today: German consumers expressed lower confidence this month, and industrial production in the eurozone was stagnant. The European Commission isn’t letting that get them down, though; it raised its growth forecast for the region to 1.7% for the year. SPDR DJ Euro STOXX (NYSEArca: FEZ) is down slightly this morning by 0.3%. [5 ETFs for the World’s Competitive Nations.]

Retail sales rose in August by 0.4%. It’s a sign of how weak consumer has been when you consider that those low numbers were the best seen in months and beat expectations. Sales were also largely driven by deep discounts and tax holidays. Vanguard Consumer Discretionary (NYSEArca: VCR) is flat so far this morning. [4 Consumer Staples ETFs for Tight Wallets.]

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.