Positive retail and real estate reports had their exchange traded funds (ETFs) moving slightly higher this morning, despite a separate report that showed remaining weakness in the jobs market.

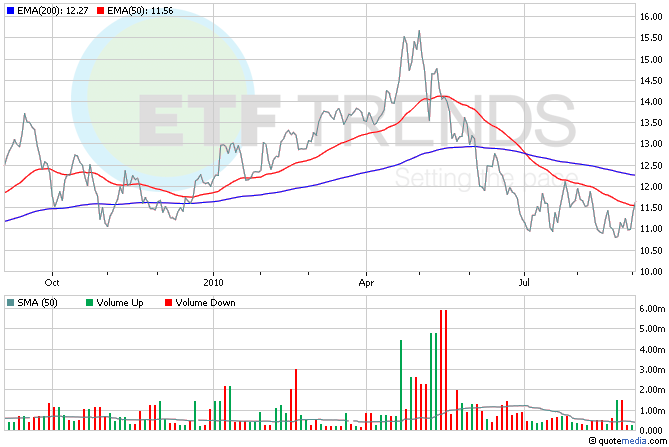

The ETF Analyzer shows that among the top-moving ETFs this morning are retail- and real-estate focused. Two of the top movers are SPDR S&P Homebuilders (NYSEArca: XHB) and SPDR S&P Retail (NYSEArca: XRT), both of which are up nearly 2%.

The National Association of Realtors’ index of pending sales of existing homes rose 5.2%. The gain surprised analysts, who expected the index to take a hit in the wake of other dour reports about the real estate sector. There’s no ETF to directly play the U.S. housing market. Your available options are REIT ETFs or homebuilders. iShares Dow Jones U.S. Home Construction (NYSEArca: ITB) is up 2.2% today. [ETFs Hit By Home Sales Plunge.]

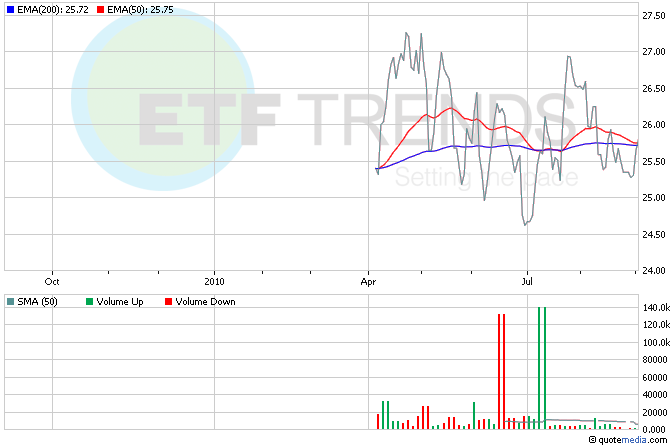

Thanks in large part to discounts and tax holidays, retail sales jumped in August. While that’s good news, shoppers are hardly spending frivolously. Spending on non-essential items, in fact, is below where it was in 2008. If consumes are spending, it’s largely on staples, which has boosted consumer staples ETFs. PowerShares S&P SmallCap Consumer Staples (NYSEArca: XLPS) is up 0.6% so far this morning; it’s up 1.2% in the last week. [‘Checking In’ Boosts Retail ETFs.]

The jobs report was decidedly mixed. First-time claims dropped slight in the last week, but worker productivity dropped for the first time in eight quarters by more than twice what was expected. Reduced productivity may ultimately mean higher labor costs, which hurts corporate profits. If this trend continues, will it translate into large-cap pain during the third-quarter earnings season? SPDR S&P 500 (NYSEArca: SPY) is up 0.5% today; for the last three months, it’s down 3.2%. [S&P ETFs vs. S&P Mutual Funds.]

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.