Talk about good news/bad news: while home sales rose last month, it was the second-worst month for home sales in more than 10 years.

That mix of news sent investors once again to Treasuries and other safe-havens. Leading the way early, according to the ETF Analyzer, was PIMCO 7-15 Year U.S. Treasury (NYSEArca: TENZ), which is up 1.5%.

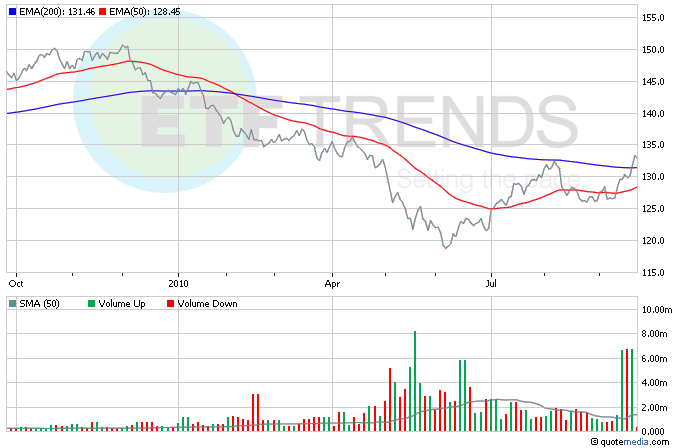

Home sales in August rose 7.6% from July, though sales dropped 19% year over year. July was the worst month for sales in 15 years. Blame concerns that prices won’t keep going up – few people want to buy a home knowing that it could still lose value. iShares Dow Jones U.S. Home Construction (NYSEArca: ITB) is down 0.2% so far today. [More Pain for Homebuilder ETFs?]

The euro dipped this morning in the wake of weak economic data about the eurozone, primarily the purchasing managers’ index, which came in weaker than expected. Also dinging the currency was a report that Irish GDP fell unexpectedly by 1.2% in the second quarter. CurrencyShares Euro Trust (NYSEArca: FXE) is down 0.3% so far today. [Falling Euro ETF Plays.]

Read the disclaimer; Tom Lydon is a board member of Rydex|SGI.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.