Homebuilders haven’t felt this bad in months. The result has been, and may continue to be, pain for homebuilder exchange traded funds (ETFs).

The National Association of Home Builders said Monday that its monthly index of builders’ sentiment was unchanged in September at 13. The index has been stuck at this low level for the past two months. Readings below 50 indicate negative sentiment about the market. [5 Good Things About REITs.]

The index is broken into three separate readings: Foot traffic from prospective buyers, an indication of future sales, fell slightly. The index measuring expectations for the next six months was unchanged. Current sales conditions were also unchanged. The last time the index was above 50 was in April 2006.

Alan Ziebel for the Associated Press reports that confidence is at its lowest level in 18 months, and the traffic of potential home buyers is disappearing. [Homebuilders Take a Hit After Sentiment.]

Factors such as high unemployment, slow job growth and tight credit have kept people from buying homes. Lenders also took back more homes in August than in any other month since the fallout. [What’s Behind the Numbers of Homebuilders ETFs?]

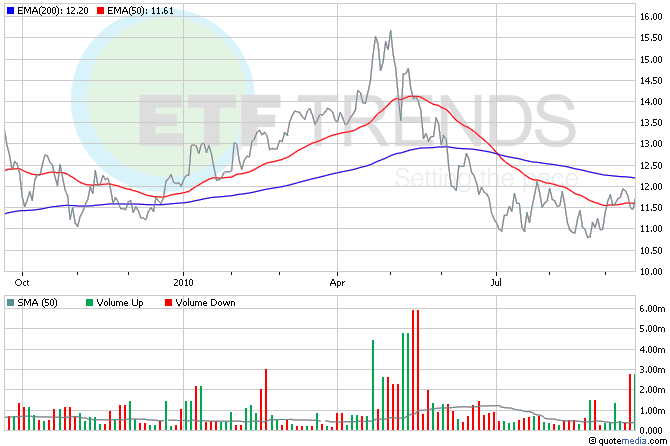

For more stories about homebuilders, visit our real estate category. Many may believe that things couldn’t get worse for homebuilders these days and be tempted to call a bottom. However, homebuilder ETFs are still clearly in pain and are about 3% below their long-term trend lines. If you’re tempted to play this sector, use an entry and exit strategy such as trend following. Here’s how to get started.

- SPDR S&P Homebuilders (NYSEArca: XHB) is down 12.3% in past six months

- iShares Dow Jones U.S. Home Construction (NYSEArca: ITB) is down 20.8% in the last six months

Tisha Guerrero contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.