The trade gap narrowed in July, jobless claims dropped in the last week and President Obama has a new jobs plan. Will it be enough to propel exchange traded funds (ETFs) higher and keep them there?

Continued signs that Americans be hopeful about the country’s economic future pushed single-country and financial ETFs higher in early trading, according to the ETF Dashboard. The leader was SPDR KBW Bank (NYSEArca: KBE), which was up 2.9% despite a nearly $27 million fine against Goldman Sachs (NYSE: GS) by British regulators.

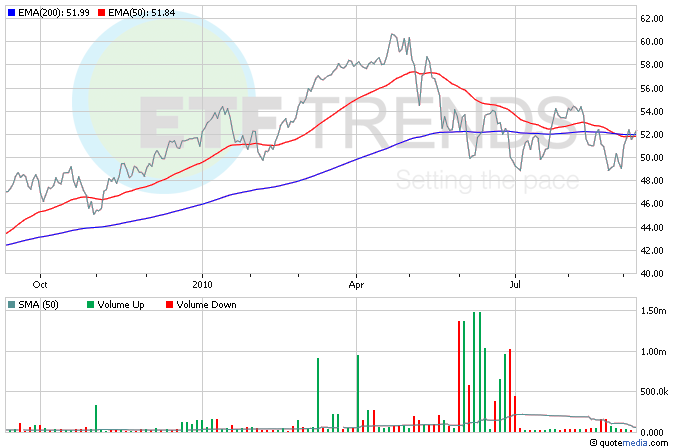

In July, the trade deficit narrowed to $42.8 billion and exports rose to the highest level in nearly two years. The move reflects huge improvements in the sale of airplanes, computers and telecom equipment manufactured in the United States. Following the news, iShares Dow Jones U.S. Aerospace & Defense (NYSEArca: ITA) is up nearly 1%; in the last 10 days, it’s up 5.8%. [Boeing Could Lift Aerospace ETFs.]

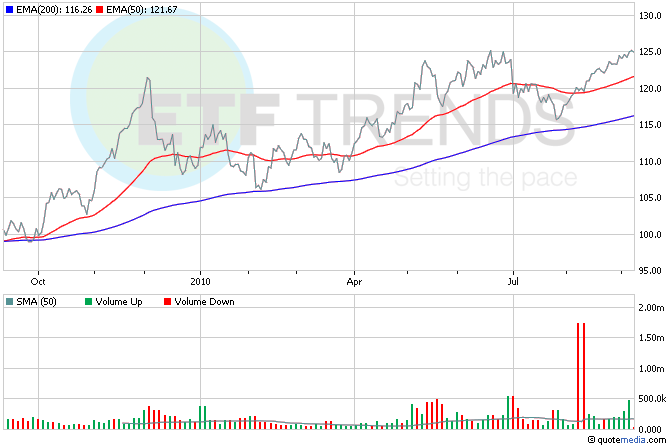

Despite improving economic figures, gold is continuing its upward march this morning, closing in on 10-week highs as investor demand goes off the charts. Silver also surged to its highest price yesterday since March 2008. If gold continues to remain at these levels, it’s on pace for its 10th annual gain. ETFS Physical Swiss Gold Shares (NYSEArca: SGOL) is down slightly this morning; in the last six months, it has gained 10.5%. [Gold ETF Soars to Record Highs.]

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.