But the difficulty that foreign banks face when trying to enter emerging markets is mutual. Emerging market banks face the challenge of entering an increasingly regulated banking environment in developed nations.

Although developing market banks have risen with the emerging market tide, they will need to need to find innovative ways to access foreign markets in order to profitably grow their business into large-scale operations that make money. [Latin America ETFs: It’s Not All About Brazil.]

One idea is to export competitive advantages. For example, in India, that would be low-cost technology. In Brazil, that would be investment banking.

If developing market banks are successful, their related ETFs are sure to profit as well.

For more stories on emerging markets, visit our emerging markets category.

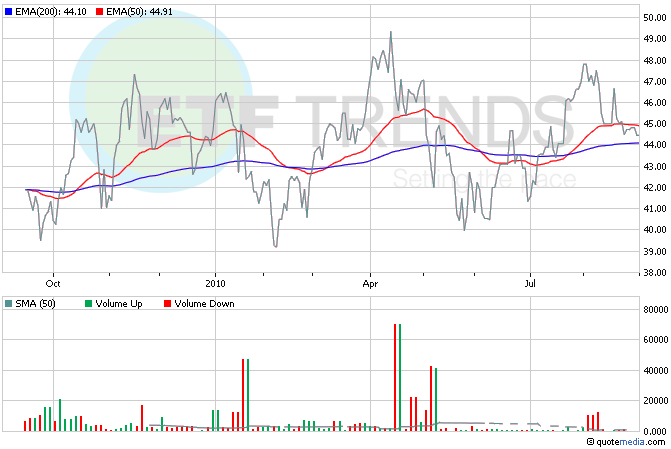

- iShares MSCI Emerging Markets Financials (NASDAQ: EMFN)

- EGShares Emerging Markets Financials (NYSEArca: EFN)

Sumin Kim contributed to this article.