It was nearly a decade ago that Russia was crowned as the R in BRIC. Since then the economy has been through its share of ups and downs, and analysts think that there might be more ups to come for the Russia exchange traded fund (ETF).

Experts predict that Russia’s economy will expand by 4.8% in 2010 and 4% in 2011, after shrinking by 8% in 2009. Russia’s bout with inflation seems over, and the resources available in the country are plentiful.

Russia is benefiting from its heavy reliance on oil, too. Martin Hutchinson for Money Morning reports that with oil at a range of $70 to $80 per barrel, the flow of resources into Russia is sufficient even for the public sector. And the economy is open enough that business can survive and flourish, which sets it apart from other oil-rich countries these days. [Are BRIC ETFs Out And CIVETS In?]

But there might be costs to the economy as a result of recent events.

Natalia Vasiklyeva for Bloomberg BusinessWeek reports that the drought and fires that hit Russia this summer will lower economic growth by at least 0.8% and are already driving prices for food staples like bread higher. Russia is not allowing any wheat exports this year, which hiked wheat prices on global markets and spurred domestic prices. [How The Drought May Affect Russia’s ETFs.]

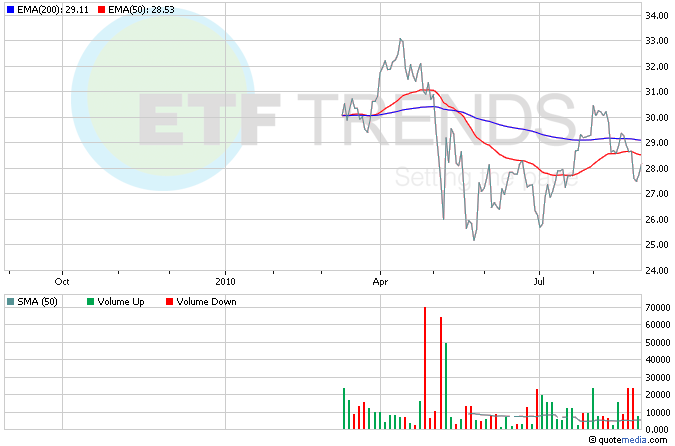

There are two single-country ETFs to access Russia’s economy; you can research them further by clicking on the ticker or by visiting the ETF Resume.

- Market Vectors Russia (NYSEArca: RSX)

- SPDR S&P Russia ETF (NYSEArca: RBL)

Tisha Guerrero contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.