While a heat wave hit the East Coast, manufacturing in the region cooled off. The discouraging report sent exchange traded funds (ETFs) lower despite news that industrial output grew slightly across the country.

Despite growth in recent months, economists feel that manufacturing activity may have peaked and that factory output may be flat for the coming months. High unemployment remains a weight on the industry as consumers stay reluctant to spend much beyond the essentials. [Direxion ETF Gives An Opportunity to Short Retail.]

- iShares Dow Jones U.S. Consumer (NYSEArca: IYC) is down nearly 1% this morning

Inflation wasn’t much of a concern last month: wholesale prices dropped for a third straight month as energy and food costs took a huge plunge. Excluding food and energy, however, prices rose 0.1%. But the dip raises the possibility of deflation, which hasn’t been seen in the United States since the Great Depression. You can use ETFs to cope with deflation by seeking out assets that would do well in such an environment. Short-term government bonds are one such option. [How to Cope With Deflation by Using ETFs.]

- iShares Barclays 1-3 Year Treasury (NYSEArca: SHY)

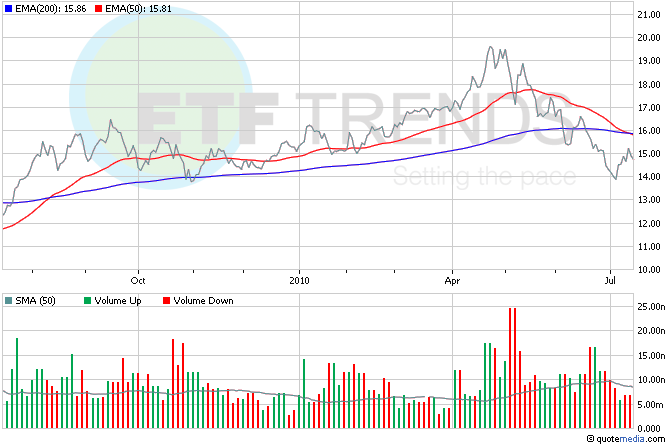

Mortgage rates are still at the lowest level in decades, remaining at 4.57% this week. That hasn’t exactly translated into new home sales or gains for homebuilder-related ETFs; in the last three months, they’re down about 19%. [Homebuilder ETFs Get Hit On All Sides.]

- SPDR S&P Homebuilders (NYSEArca: XHB)

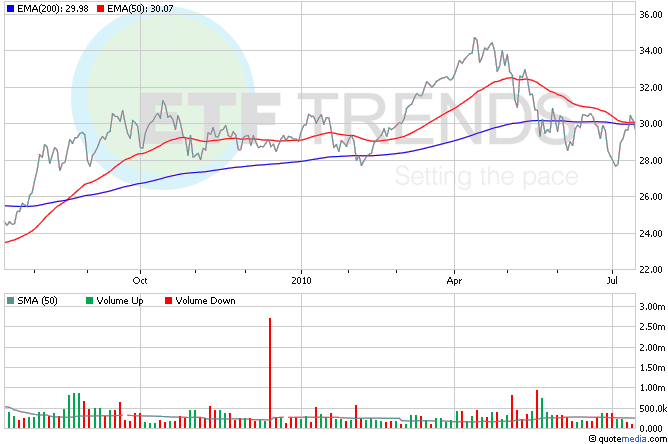

Today after the market close, Google (NASDAQ: GOOG) will report earnings. JPMorgan (NYSE: JPM) reported its second-quarter results, which were better than expected. Net profit for the banking giant rose 76% from a year ago to $7.8 billion. Citigroup (NYSE: C) and Bank of America (NYSE: BAC) will be up with earnings tomorrow. [ETF Strategies for Financial Reform.]

- Vanguard Financials (NYSEArca: VFH) is down nearly 2% this morning; BAC is 8%; JPM is 9%; C is 4.2%

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.