The monthly unemployment numbers weren’t as bad as expected, but they still signal a pervasive weakness in the recovery. In kind, stocks and exchange traded funds (ETFs) traded in a narrow, but mostly negative, range.

A wave of census layoffs cut the payrolls in June for the first time this year, although private employers added a small number of jobs. The good news is that unemployment declined to 9.5%, the lowest level in a year. But don’t get excited: the drop is the result of discouraged job seekers giving up on their searches. As unemployment continues to limp along, ETFs aimed at the real estate and retail sectors could be among the most affected as consumers stay cautious and scale back. On the upside, consumer staples ETFs might stay stable as shoppers buy at the very least the essentials they need. [Craving Fast Food? Here Are 4 ETFs.]

- Rydex S&P Equal Weight Consumer Staples (NYSEArca: RHS) is up 0.5% this morning

Further evidence of a tepid recovery: U.S. factory orders fell 1.4% in May, the largest drop since March 2009. Excluding transportation, orders were off by 0.6%. The weakest performers were electronics and commercial aircraft. Transportation ETFs are feeling the pinch, declining more than 2% in early trading. [Airline ETF Cleared for Takeoff.]

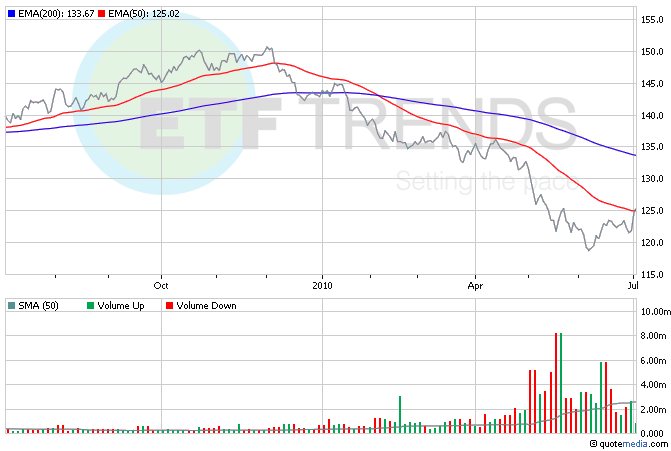

- iShares Dow Jones Transportation (NYSEArca: IYT)

As a result of the jobs report, the dollar sank to its lowest level since May against the euro, which rose to $1.26. Euro-focused ETFs are rising in kind, getting a break from downward pressure over the last several months. [Euro ETFs Riding High, But Can It Last?]

- CurrencyShares Euro Trust (NYSEArca: FXE) is up 0.5% so far this morning

Read the disclaimer; Tom Lydon is a board member of Rydex|SGI.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.