But even with the pending reforms, the sovereign debt crisis and the oil spill, Bob Bishop of SCM Advisors thinks the spreads on some corporate bonds are pretty attractive. He also says, “Though the outcome of financial regulatory reform is still unclear, its impacts may not be as bad for bondholders as many fear.”

If you’re looking to invest in bond funds, Forbes gives a brief overview of some high-yielding bond funds, including those listed below.

For more stories about bonds, visit our bond category.

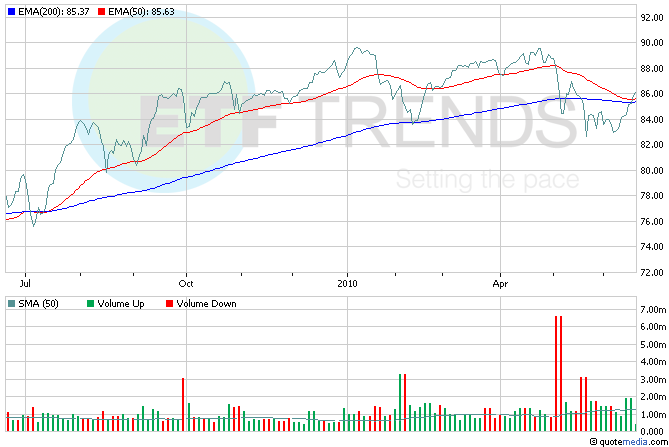

- SPDR Barclays Capital High Yield Bond ETF (NYSEArca: JNK)

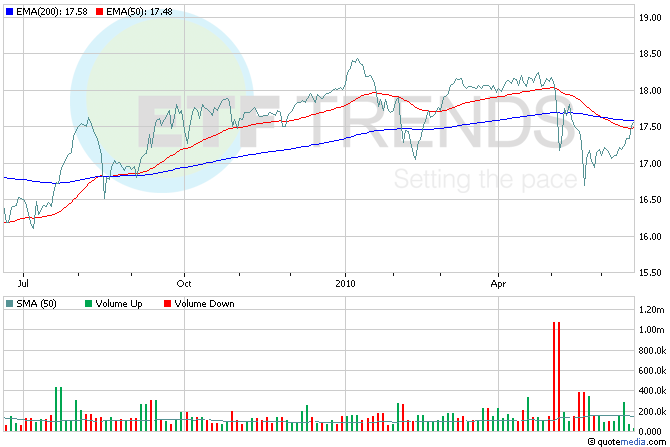

- iShares iBoxx $ High Yield Corporate Bond Fund (NYSEArca: HYG)

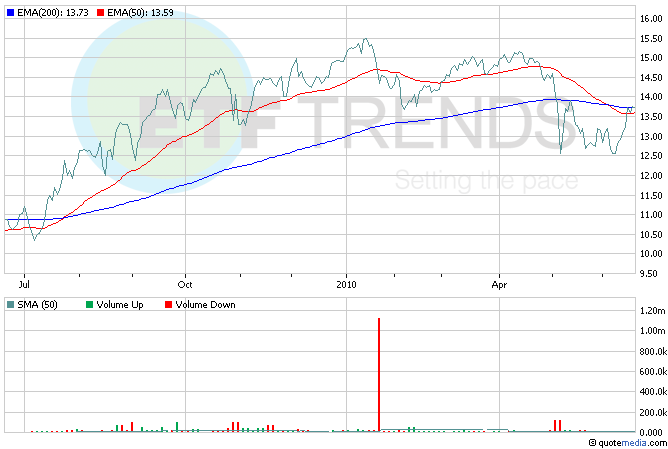

- PowerShares High Yield Corporate Bond Portfolio (NYSEArca: PHB)

- Claymore/S&P Global Dividend Opportunities Index ETF (NYSEArca: LVL)

For full disclosure, Tom Lydon’s clients own shares of JNK.

Sumin Kim contributed to this article.