Mutual funds have long been a trusted and popular form of investment, but are they going the way of the dinosaurs? Exchange traded funds (ETFs) are quickly becoming the investment tool of choice and their popularity is only beginning to grow.

According to a new study by research provider Novarica:

- Mutual funds will be drastically diminished from 8,022 mutual funds in 2008 to just 4,237 by 2015

- The number of ETFs will shoot up from 728 in 2008 to 2,618 by 2015

- Actively managed ETFs will increase from currently fewer than 10 to 325 by 2015

- Assets in traditional mutual funds will decrease from $9 trillion to $6.75 trillion

- ETF assets will increase from $500 billion to $1.15 trillion

The numbers are strangely specific, and Heather Bell for IndexUniverse notes that Novarica doesn’t describe how they arrived at them.

The rationale behind the numbers is that ETFs will only grow because they are so much cheaper than actively managed mutual funds. Potential investors are also attracted to the liquidity and ease of trading provided by ETFs.

Can the industry do it? We’ll see – some signs in favor of the argument:

- If ETFs become a staple in 401(k) plans, it could open the door to a plethora of opportunities

- Many major and highly respected names are getting into ETFs, including Pimco, Charles Schwab and Russell – this could add even more appeal to the industry for skeptical investors and other mutual fund names

- There’s an increasing amount of frustration on the part of investors when it comes to mutual funds – lack of transparency, high prices and a lack of immediate liquidity could send more investors to ETFs

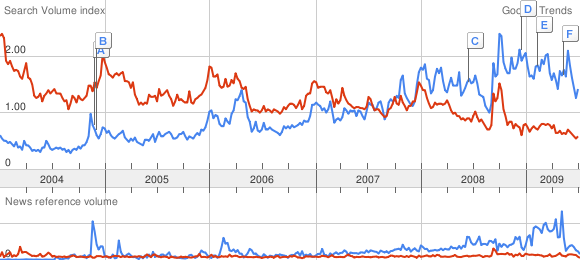

- Just look at the trends. According to Google Trends, after the Fed started to help money market mutual funds in Oct. 2008, the search volume for the term “ETF” began to outstrip that of mutual funds, illustrated in the chart below; also, the volume of searches for ETFs is way higher than mutual funds in general – crazy!

(Click to enlarge; the red line represents mutual funds, the blue line represents ETFs)

(Click to enlarge; the red line represents mutual funds, the blue line represents ETFs)

Max Chen contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.