Investors beware, there is a possible new financial bubble forming and it appears to be in the U.S. Treasury market and the exchange traded funds (ETFs) that track the sector.

The collapse of the stock market has lead to fear in investors and an attraction of money and assets to the Treasury market, sending bill, note, and bond prices soaring. Jim Juback of MSN Money states the following reasons for a bubble in this area of the market:

- The U.S. Treasury sold a record $40 billion in two-year notes at higher prices and lower yields than expected. The sale drew bids of $2.69 for every $1 in Treasury notes, up from the $2.13 bid price of the previous auction.

- Goldman Sachs (GS) estimates the U.S. Treasury to offer $2.5 trillion in bills, notes and bonds for sale in fiscal year 2009, which will be a record and $1.6 trillion higher than 2008.

- 34.6% of notes sold were purchased by indirect buyers, which includes overseas central banks.

- Investors would rather play it safe and invest in a 10-year Treasury note paying 2.52% than an investment grade bond, like the one offered by Pepsi Bottling Group (PBG), with a yield of 5.13%.

- Treasuries are being offered at a hair over inflation; the three-month bill yields 0.12%, the two-year note yields 0.8%, the five-year note is at 1.56%, the 10-yr. bond yields 2.53% and the 30-year bond yields 3.24%.

On the one hand, this could be good news for the debt stricken U.S. government and probably won’t inflict as painful a blow as the bursting of the last two bubbles. On the other hand, inflation will probably not stay at its current rate of 1.8% and interest rates will most likely increase as economies recover, resulting in a burst bubble and a loss of money.

Most bubbles are caused by the desire to make a quick buck, this one seems to be caused by the fear of losing a quick buck. Don’t panic, just diversify, don’t put all your eggs in one basket and stay up to par on financial news.

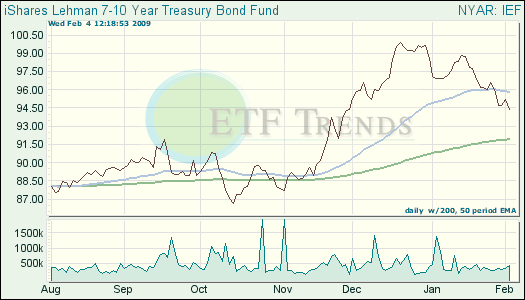

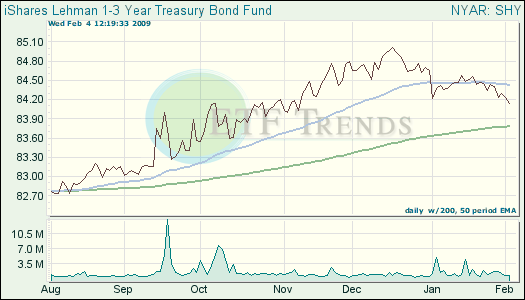

Take a look at the following Treasury ETFs:

iShares Lehman 7-10 Year Treasury Bond Fund ETF (IEF): down 2.0% over the last month

iShares Lehman 1-3 Year Treasury Bond Fund ETF (SHY): flat over the last month

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.