The day has arrived for President Barack Obama to sign the finished stimulus bill. This rescue plan is intended to refresh the job market, consumer spending and the faith of the people, as well as rally markets and exchange traded funds (ETFs). But will it?

Ben Feller for Associated Press reports that the chosen locale is he Denver Museum of Nature & Science, which is meant to underscore the investments the new law will make in “green” energy-related jobs. Not only does this allow Obama a break from Washington, it allows him to be among those who will directly benefit from his stimulus.

So, what is in this stimulus exactly that will help you? Ron Lieber for The New York Times helps us sort this out:

- Income Tax Breaks: For 2009 and 2010, there is a tax credit of up to $400 for individuals and $800 for married couples filing their taxes jointly. You calculate your credit, subtracted from other federal taxes you owe, by taking 6.2% of your earned income. Couples who earn more than $150,000 and individuals who make more than $75,000 are phased out.

- Unemployment, Health Insurance, Social Security Targeted: Federal income taxes on unemployment benefits will be forgiven if you received aid. In 2009, however, you won’t have to pay taxes on the first $2,400 in benefits you receive. The Cobra law will also be in effect so that if you were fired, your health insurance benefits will extend for 18 months after termination for $1,000 per month. The Federal government is going to subsidize 65% of the premiums for up to 9 months. Social Security recipients, will receive a $250 refundable tax credit. The money would arrive within 120 days of the bills signing.

- Breaks For Car Buying: For the rest of 2009, you’ll be able to deduct the state and local sales and excise taxes you pay on the purchase of a new (not used) car, light truck, recreational vehicle or motorcycle. As an above-the-line deduction, you can take it regardless of whether you itemize other deductions on your tax return.

- Tax Credits For First-Time Homebuyers, Higher Education: If you spend $4,000 per year on college tuition, a $2,500 credit will cover you in 2009-2010. 529 college savings plan money can be used for education as well as computers and technology. First-time home buyers are eligible for a refundable tax credit equal to 10% of the purchase price of their home, up to $8,000, if they made the purchase after Jan. 1, 2009, but before Dec. 1, 2009. The payback is forgiven if you remain in the house for three years.

And on Wednesday in Arizona, Obama will unveil another part of his economic recovery effort – a plan to help millions of homeowners fend off foreclosure.

Meanwhile, in the depths of retail, Wal-Mart (WMT) stores are reporting a 7.4% profit decline for the fourth quarter. The strengthening dollar and a labor dispute took the company’s numbers down. Anne D’Innocenzio for the Associated Press reports that the foreign exchange rates are a looming problem for the first quarter reports, however, shares are up 3% despite the changing atmosphere. The discount chain is beating analysts’ expectations and taking down the competitors from apparel to electronics.

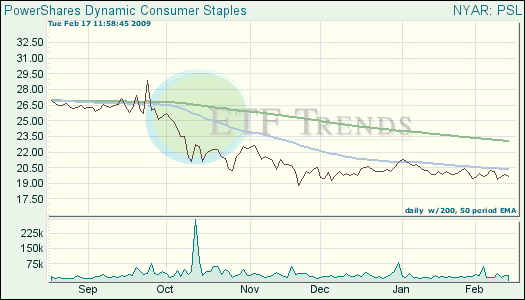

- PowerShares Dynamic Consumer Staples (PSL): up 4.4% over three months; up 1% in one month.

The manufacturing slump in New York is at a record slowdown for February, as new orders and unemployment are a deepening problem. The Associated Press reports that the New York Federal Reserve’s Empire State factory index fell to minus 34.65 – the lowest in the history of the index, which dates back to July 2001. January’s number was already contractionary at minus 22.0.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.