Hong Kong’s inflation rate seems to have been affected by the three-day Chinese Lunar New Year, but not enough to hinder progress within markets and related exchange traded funds (ETFs).

The Bad. In Hong Kong, consumer prices rose 3.1% from one year earlier, but has cooled down from 2008’s 6.3%, as financial crisis has settled in. Nipa Piboontanasawat for Bloomberg reports that the holiday, which fell in February 2008, gave a temporary boost to consumption as families bought clothes, furniture and food to celebrate.

The Good. This event will not reverse the previous trend if the economy continues to contract. Lu Yanaan for China View reports that Hong Kong’s service sector stands to benefit from the stimulus package unveiled by the central government last November.

The stimulus package is intended to boost domestic demand, and focus on construction and infrastructure projects, particularly on the Mainland. Hong Kong companies are backed by strong funding and technical expertise.

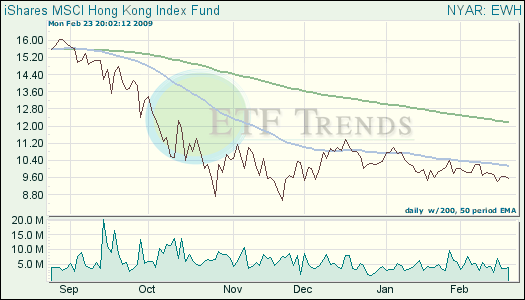

- iShares MSCI Hong Kong Index (EWH): up 8.3% over three months; up 5.3% in the last week.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.