John Stepek for MoneyWeek reports that besides Japan, it is hard to see where the money will come from. Most of the world’s major economies are spending billions bailing out their own populations, never mind anyone else’s.

Other Bailouts Not Working Yet. Although countries such as the United Kingdom and the United States is getting billions poured in, the money does not seem to be doing them any good. The recession is looming deep for many countries and banks know this and are ready to hibernate. They are aware that as the recession grows, so does the number of people who wont pay you back.

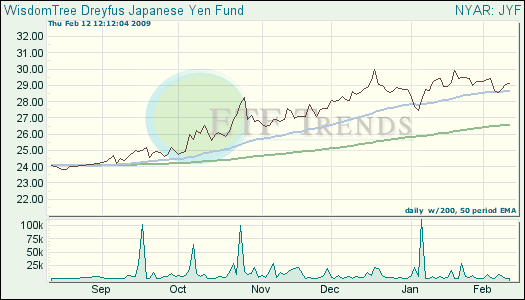

Strong Yen. Although Japan is feeling the effects of the downturn due to falling export demand, the yen is strong enough to consider the other assets cheap. Assets in Brazil, Turkey and Mexico are where investors are looking to park their money.

And if the yen weakens this year – perhaps if the central bank intervenes to try to weaken the currency and help out exporters – then any Japanese investor holding overseas assets would see a nice boost to their value.

- iShares MSCI Emerging Markets (EEM): down 3.8% year-to-date

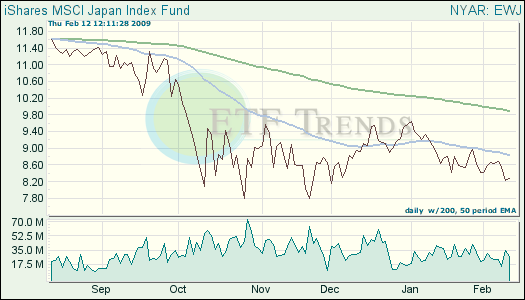

- iShares MSCI Japan Index (EWJ): down 4.7% over three months; down 13.7% year-to-date.

- WisdomTree Dreyfus Japanese Yen Fund (JYF) up 8.4% over three months; down 1% over one week