It seems like there are bargains and sales all over the place these days, and health care stocks and exchange traded funds (ETFs) may be no exception.

For the past 52 weeks, these shares have lost an average of 24%, so are the related ETFs a true value? Health care stocks are typically defensive, but have fallen on the wayside as of late. Ron DeLegge for ETFGuide reports that the decline has made for some nice valuations within the sector, and has caught the interest of many alert investors. President Barack Obama’s administration intends to make health care a priority, as well, which could give the industry an assist.

It is important for investors to watch the trend lines before jumping into any stock or ETF, and to enter with a solid strategy they can stick to. Here is a look at a few health care ETFs and take note of their differences, as they all have something different to offer:

iShares Dow Jones U.S. Health Care (IYH) down 4.4% over past three months; gives exposure to 139 stocks in the health care sector and are chosen based upon market share or size. The average market cap of selected stocks is at $2 billion.The expense ratio is 0.48%.

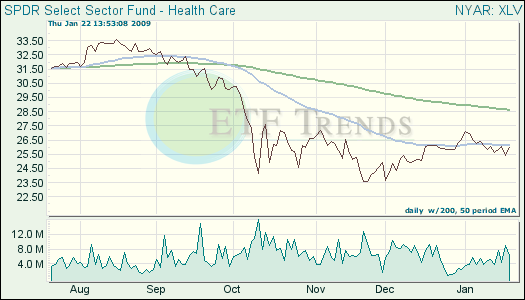

Health Care Select Sector SPDR (XLV) down 3.5% over past three months; represents health care stocks found within the S&P 500. This is the largest ETF in the sector and it focuses on companies involved in health care equipment and supplies, health care providers and services, biotechnology, and pharmaceuticals makers. XLV’s annual expenses are being cut to 0.21% beginning Jan. 31.

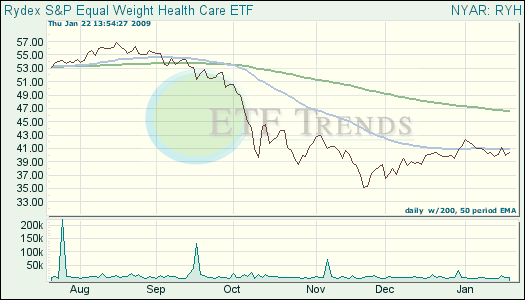

Rydex S&P Equal Weight Health Care ETF (RYH): down 7.4% over past three months; This ETF follows the health related stocks within the S&P but stocks are weighted equally, rather than by market cap. The lean is toward small to mid-size companies. The index is rebalanced every quarter. RYH’s annual expense ratio is 0.50%.

And while the new administration could someday have an impact upon health care stocks; as of right now, nobody knows what will happen. The sector at large is appealing to a value-based investor and the differences within each ETF should help discern which one is right for your investment needs.

Read the disclosure, as Tom Lydon is a board member of Rydex Funds.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.