Retail chains had one of their worst holiday seasons on record, according to data released this week, sending dismay throughout markets and retail exchange traded funds (ETFs).

Most stores reported declines and many lowered their earnings guidance,as November and December turned out to be a slower-than-usual period for retail. On average the sales in the last two months of the year are plenty, and these sales are 25%-40% of the retailers’ annual sales, reports Stephanie Rosenbloom for The New York Times.

Wal-Mart (WMT) was the December winner, if there were any, as they are touted as the low-price leader, and had a same store sales increase of 1.7% in December. However, the retailer missed the mark on analysts’ expectations, and they expect little change, with January sales to be flat or up 2% at most.

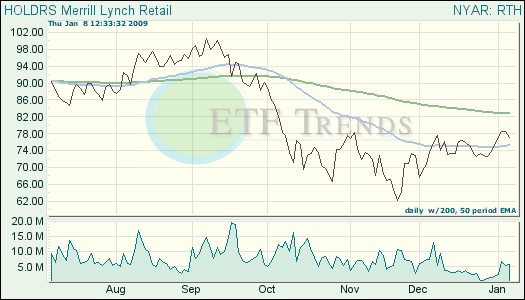

- Retail HOLDRs (RTH): down 0.7% for the last month; Wal-Mart 26.9%; Walgreen Co. 6.2%

Other retailers such as Macy’s are closing 11 stores in nine states that are below par, reports Mae Anderson for the Associated Press. These cuts will affect 960 employees and the company has lowered fourth-quarter earnings after a weak holiday season.

Walgreen’s also has job cuts looming, as 1,000 management jobs are to be cut due to buyouts and layoffs. Katherine Wegert for The Wall Street Journal reports that the company said the job cuts will come from corporate and field management and won’t include store employees. The targeted workers will be able to resign or retire with severance pay and benefits based on their tenure. In February, further layoffs will begin with less desirable terms.

This will only undermine and add to the rising number of people seeking unemployment benefits in the United States, which also means workers are having a hard time finding replacement work. The number of people continuing to claim jobless benefits jumped unexpectedly by 101,000 to 4.61 million, exceeding analysts expectations of 4.5 million.

The Associated Press reports that this is the highest level since 1982, when the country was experiencing a steep recession, however, the labor force has grown by half since then.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.