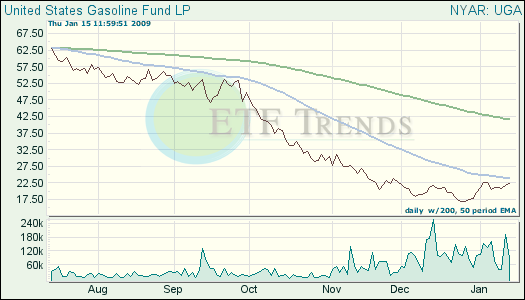

Wholesale inflation has fallen to its lowest level in seven years, primarily because of the drop in energy prices, giving little hope to markets and exchange traded funds(ETFs) for the near future.

Wholesale prices fell by 1.9% in December, below the 2% of the economists’ predictions, settling fears that sky-high energy prices could send the U.S. economy into a battle with inflation, reports Martin Crutsinger for Associated Press. Deflation, or a bout of declining prices, is the next fear concerning economists regarding the U.S. economy.

- United States Gasoline (UGA): down 41.7% over past three months

JP Morgan Chase (JPM) reported a $702 million profit for the fourth quarter, with $2.8 billion in losses concerning a wide range of businesses. Michael de la Merced and Eric Dash for The New York Times report that the investment bank faced troubles with trading and corporate lending to credit card and mortgage lending as it confronted the worst housing and job markets in decades.

The report sent JPMorgan’s shares higher in early trading. Minutes after the market opened, shares were up 2.5%, or 64 cents, to $26.55. The bank is considered to be in a better position than its rivals, and they are the first bank to release earnings in the red.

Bank of America (BAC) shares are also plunging this morning on fears that the company needs more government aid to absorb losses after acquiring Merrill Lynch, says David Mildenberg for Bloomberg.

Earnings reports due out today also include Genentech (DNA) and Intel (INTC).

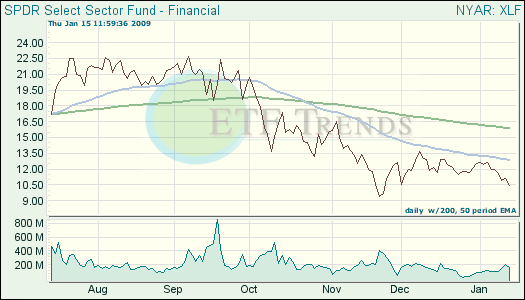

- Financial Select Sector SPDR (XLF): down 38.8% over past three months; JP is 11.1% of assets; Bank of America is 7.8%.

Meanwhile, investors are sending Apple (AAPL) shares lower on news that CEO Steve Jobs is taking a leave of absence until June, reports Yukari Iwatani Kane for The Wall Street Journal.

Are the Democrats solid in a stimulus package yet? The circulating proposal is a $825 billion package that considers health care, education and highway construction as well as tax cuts for individuals and businesses, reports David Espo for the Associated Press. Although totals are going to shift, the spending is around $550 billion, with $275 billion in tax cuts. Mid-February is the due date, when President-elect Barack Obama is expected to sign the bill.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.