Sector allocation for the fund: consumer discretionary, 8.5%; consumer staples, 1.9%; energy, 18.7%; financials, 5.9%; health care, 5.3%; industrials, 12.1%; information technology, 23.1%; materials, 7%; telecom services, 12.8%; utilities 4.7%.

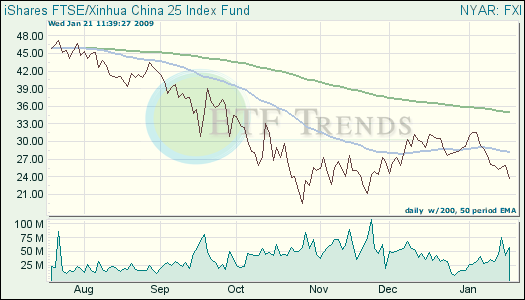

iShares FTSE/Xinhua China 25 Index (FXI): Has total assets of $29.3 billion, 50 holdings and an expense ratio of .74%. FXI tracks the underlying index FTSE/Xinhua China A50 Index, which provides investment results that correspond generally to the performance, before fees and expenses, of publicly traded securities, A-shares, in the Chinese market.

Sector allocation for the fund: banks, 31.6%; life insurance, 9.9%; electricity, 7.8%; industrial metals, 6.7%; general financial, 6.4%; industrial transporation, 5.5%; oil & gas producers, 5.2%; construction & materials, 4.9%; real estate, 4.4%; mining, 4%; beverages, 3.9%; mobile telecom, 3%; general retailers, 2.61%; other 4.2%

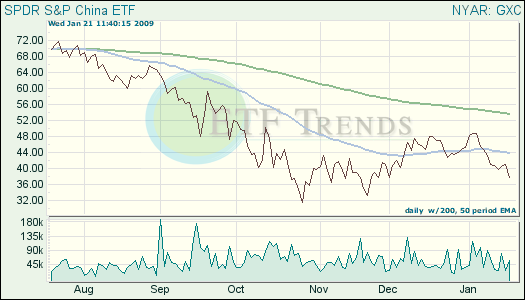

SPDR S&P China (GXC): Has total assets of $127.9 million, 124 holdings and an expense ratio of 0.6%. The ETF seeks to match the returns and characteristics of the total return performance of the S&P China BMI Index. The S&P China BMI Index is a market capitalization weighted index that defines and measures investable publicly-traded companies located in China, but available to foreign investors. The China Index is “float adjusted.”

Sector allocation for the fund: financials, 31.7%; telecom services, 19.2%; energy, 18.4%; industrials, 9.1%; information technology, 6.2%; materials, 4.7%; consumer discretionary, 4.3%; consumer staples, 3.4%; utilities, 2.9%; health care, 0.30%

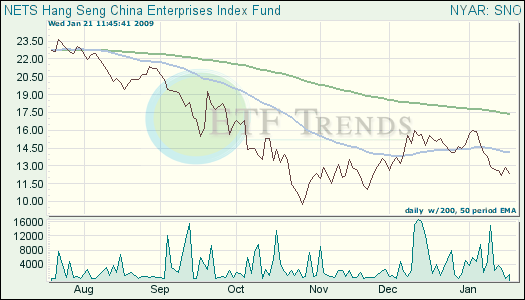

NETS Hang Seng China Enterprises Index (SNO): Total net assets are $1.3 million, 43 holdings and an expense ratio of 0.51%. SNO mainly corresponds to the performance of H-Shares of Chinese enterprises traded primarily on the Stock Exchange of Hong Kong, which are weighted according to a free-float adjusted, market-capitalization weighted methodology. It has a reported 15% cap on stock weights.

Sector allocation for the fund: financials, 55.4%; energy, 22%; properties & construction, 7.5%; materials, 4.5%; services, 3.7%; telecom, 3.4%; utilities, 1.9%; consumer goods, 0.9%; industrial goods, 0.80%.