Persistent talk of a bubble is hovering over the Treasury market and related exchange traded funds (ETFs), and like all bubbles, it must burst at some point in time. Is the Treasury rally nearing an end anytime soon, though?

Even though yields are near all-time lows, it is still too early to tell if the Treasury bubble is about to burst. Some of the better-performing ETFs tracking this market have had down days. Rob Viglione for Seeking Alpha points out that the VIX volatility index has shown receded swings in the general equities markets, making the possibility of a bond bust much more likely.

Goldman Sachs came out with a report today saying that the Treasuries are not in a bubble, and in fact, they’re trading close to a measure of “fair value.” Their prediction is that that while investors shift their focus toward recovery, yields will likely drift higher, but in line with forecasts. By the end of the year, analysts feel that 10-year yields will trade at 3% to 3.25%, reports Liz Capo McCormick for Bloomberg.

The downward slide in yields is because of an investor flight to quality, at one point sending them to 0% and even dipped into negative territory.

Today’s yield on the 30-year bond is at 3.02%, up from 2.68% last week. The three-month yield is down slightly from last week’s 0.07% to 0.04% today.

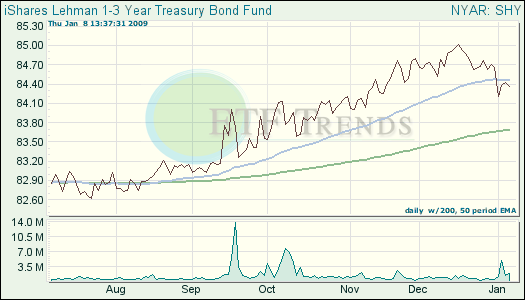

- iShares Barclays 1-3 Year Treasury Bond (NYSEArca: SHY): up 0.7% over three months, and it has a yield of 3.3%.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.