Sweden is putting efforts to boost its economy and exchange traded fund (ETF) on the fast track.

The country’s central bank met today, two weeks ahead of schedule, for a monetary policy meeting where an interest rate decision will be published, reports Joel Sherwood for The Wall Street Journal.

The Bank of England and the European Central Bank also are set to announce interest-rate moves today. Riksbank said as of Thursday, a new decision will be in effect. The meeting was originally scheduled for Dec. 16, but any improvement will not come too soon.

The economy slid into a recession in the third quarter on weakened demand for exports, reports Johan Carlstrom for Bloomberg.

A 1% rate cut is expected, with more cuts into 2009, taking the repo rate to 1.25% into the next year. A one-point rate cut today would be the largest since the bank adopted an inflation target 15 years ago.

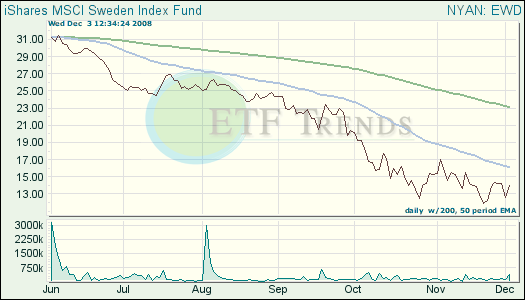

- iShares MSCI Sweden (EWD): down 52.2% year-to-date; whether a rate cut of this size will be enough to reverse course in the fund remains to be seen.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.