The Global Hedge Fund Index, designed to represent the overall composition of the global hedge fund universe, is down 22.7% year-to-date. It normally has a two-day lag, so it remains to be seen how the latest developments influence the index.

Hedge funds are largely unregulated, and they’re mysterious entities only open to a select few investors. They’ve seen heavy redemptions this year, and this could be the straw that breaks the camel’s back. Even decently performing hedge funds, in fact, are said to have been seeing such heavy withdrawals that they’ve halted redemptions.

Those who invest in them are placing a lot of trust in the companies that run them. But will people be wondering now whether they can be trusted after all? We won’t know all the ramifications for awhile, but it may not be pretty.

- iShares MSCI Spain Index (EWP): down 40.7% year-to-date; Santander 18.1%

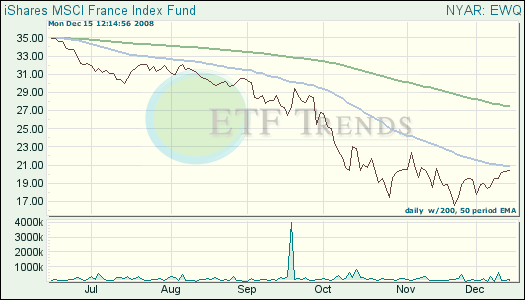

- iShares MSCI France Index (EWQ): down 44.4% year-to-date; BNP Paribas 7%