Christopher S. Rugaber for Associated Press reports that the manufacturing barometer shows activity fell to a 26-year low in November, a consecutive drop for 12 months. Analysts were calling for a reading of 38.4, but instead got a reading of 36.2 for November. This is the lowest since November 1982, the time of a dark recession for the economy in the United States.

Another indication of a deep recession for the economy lies in the construction spending that fell in October. A major loss in homebuilding is another result of the economic slowdown, and has fallen at a steady beat for the past two and a half years, reports Martin Crutsinger for Associated Press.

The Institute for Supply Management said its gauge of manufacturing activity fell to a reading of 36.2 in November, a 26-year low.

- Industrials Select Sector SPDR (XLI), down 40.1% year-to-date

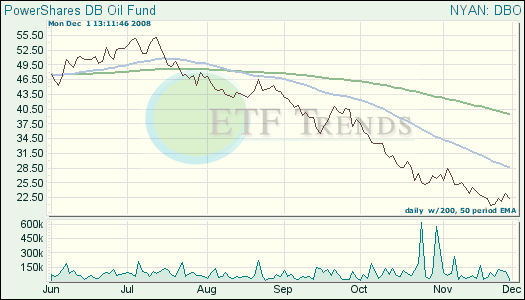

The continued downward momentum of oil is validated by the 26-year low in manufacturing activity in the U.S. The numbers are worse than expected and OPEC has not announced a production cut of crude earlier than the next meeting, three weeks away, reports Mark Williams for Associated Press.

Light, sweet crude for January delivery fell nearly 7%, or $3.67 to $50.76 a barrel and set at $54.43 as of Friday.

- PowerShares DB Oil ETF (DBO), down 35.5% year-to-date