India’s economic expansion is posed to continue receding as exports fell for the first time in seven years this October, sending related shares and exchange traded funds (ETFs) down.

- India is adding interest rates and tax cuts announced earlier this month to make up for their declining output and exports, indicating a deeper slowdown than expected. The economy will slow but not at a rapid pace, giving the government time to shore up, reports Nipa Piboontanasawat and Kartik Goyal for Bloomberg.

- Inflation also stands above “acceptable” levels, according to the country’s central bank, making monetary policy management more difficult. The Reserve Bank of India cut the repurchase rate by 1%, to 6.5%, earlier this month. It’s the third cut since October, say Kartik Goyal and Arijit Ghosh for Bloomberg.

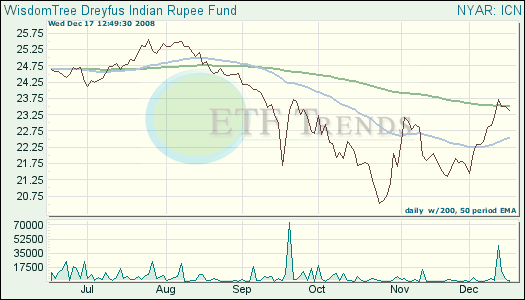

- The rupee is coming off one-month highs, but it’s still feeling stronger after rate cuts by the Federal Reserve, reports Swati Bhat for Reuters. Foreign institutional investors have been net buyers of about $440 million of Indian shares in December, but they’ve dumped a net $13.2 billion in 2008.

- WisdomTree Dreyfus Indian Rupee Fund (ICN): down 5.2% since May 22 inception

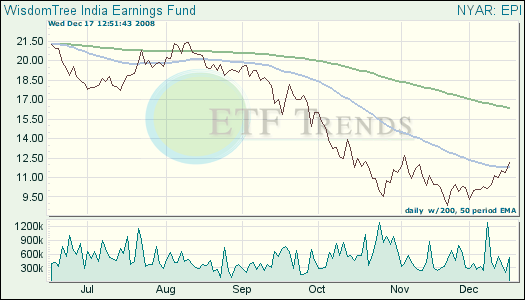

- WisdomTree India Earnings (EPI): down 53.5% since Feb. 26 inception

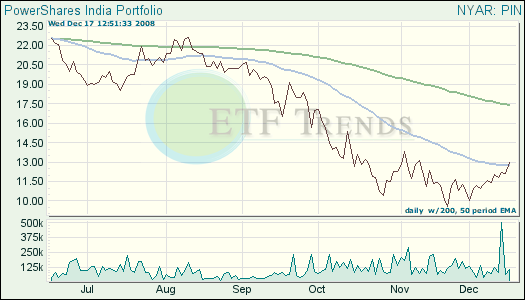

- PowerShares India (PIN): down 49.3% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.