Democrats are in the house and investors and exchange traded funds (ETFs) focusing on defense and military contractors need to be examined, because there are compelling arguments on both sides as to whether their future is bearish or bullish.

According to Merrill Lynch, aerospace and defense has done better under a Democratic rule, especially during a recession, because national security is a good hedge against the broad market, says Pauline Miniter for SmartMoney.

Investors are nervous about President-elect Barack Obama, as many think that while defense spending may not slow, there is going to be a shift of priorities in Washington.

Obama’s administration plans to cut defense spending, which will cut into profits. However, as Joe Biden puts it, it won’t be six months into the new administration when a rogue state will test the new president. There’s still enough uncertaintly in the world that defense companies should remain relevant.

Shareholders in companies such as Raytheon (RTN), Boeing (BA), Lockheed Martin (LMT), and Northrop Grumman (NOC) are left feeling vulnerable as losses ranged from 20% to 50% in the last year.

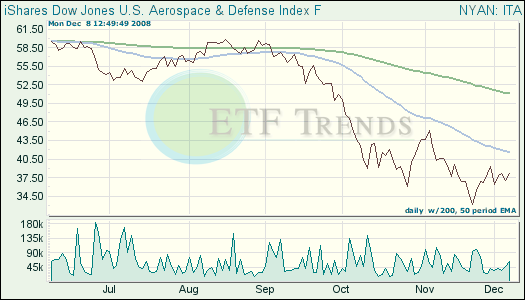

- iShares Dow Jones U.S. Aerospace & Defense (ITA): down 43.6% year-to-date; Boeing is 8.4%; Raytheon is 7.8%; Lockheed Martin is 7.8%; Northrop is 5.3%

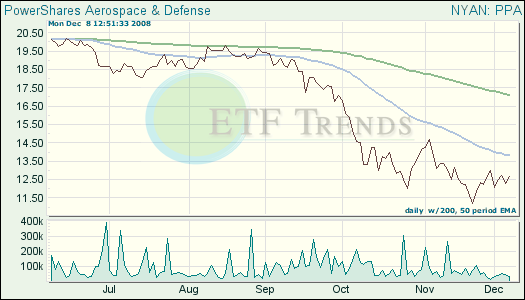

- PowerShares Aerospace and Defense (PPA): down 43.9% year-to-date; Boeing is 8.5%; Lockheed Martin is 7.2%; Raytheon is 5.8%; Northrop is 4.3%

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.