As the economy worsens, President-elect Barack Obama is stepping up with a more expanded economic recovery plan and a way to help Wall street and exchange traded funds (ETFs).

The soon-to-be President of the United States is seeking to create 3 million more jobs within 2 years, up from the original 2.5 million. While this won’t offset the 4 million jobs already lost and those that could be coming down the pike, it’s a start.

Jackie Calmes for The New York Times reports that the multifaceted economic plan would cost $675 billion to $775 billion, and would likely grow as it went through Congress. A ban for add-on spending for pet projects is also agreed upon among Democratic leaders.

The hope is that this plan will wind its way through Congress quickly and be ready for Obama’s signature shortly after he takes office on Jan. 20.

Job creation would involve the areas of information technology in medical buildings, construction work on roads, mass transit projects, and weatherization of government buildings. The Obama blueprint covers five main areas of spending and tax breaks: health, education, infrastructure, energy, and support for the poor and the unemployed.

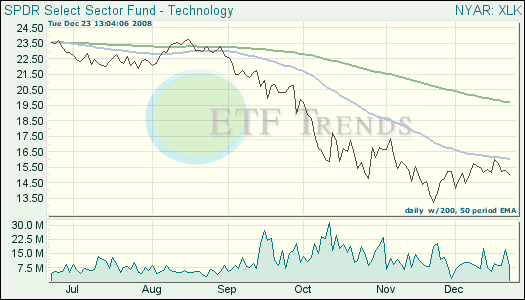

- Technology Select SPDR (XLK): down 43.1% year-to-date