For the fifth time in four months, China slashed interest rates in hopes of reigniting their flagging economy and exchange traded funds (ETFs).

The last few rate cuts haven’t done the trick, as consumers continue to pull back from spending, and manufacturing activity continues to decline, reports Joe Mcdonald for the Associated Press. Their benchmark one-year lending rate will decline by 0.27% to 2.25% starting Tuesday.

Just four weeks ago, China made its biggest rate cut in 11 years, and left the benchmark at its lowest level since February 2004. Despite all the problems, China’s economy is still expected to notch 9% growth this year, a rate that many economies would love.

Next year’s growth forecast is set as low as 6%. Last year, China’s economy grew 11.9%.

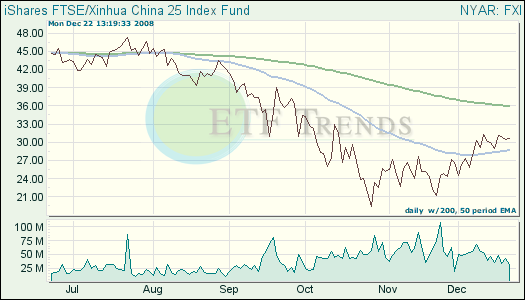

- iShares FTSE/Xinhua China 25 Index (FXI): down 45.5% year-to-date

Oil prices continue their descent, unswayed by OPEC’s 2.2 million barrel production cut, reports Dirk Lammers for the Associated Press. Dour reports from Toyota and Caterpillar, coupled with an overall worsening global economy, are pushing prices below $42 a barrel midday.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.