Gas prices have dipped back down in consumers’ favor, naturally spurring talk of a bottom for related exchange traded funds (ETFs).

Many are enjoying this newfound “freedom” of filling up at the pump without draining your wallet.

But if the bottom is near and prices are indeed bound to head north again, there’s a way to hedge with the gas ETF and lock in the low prices.

Michael Cintolo for Seeking Alpha has this equation for any of you that own a few cars or a small driving-based business:

Let’s say you drive approximately 14,000 miles a year and your car gets 20 miles per gallon. That means you use about 700 gallons of gasoline per year (14,000 divided by 20 = 700). At the current rate of about $2 per gallon, that means you’re spending $1,400 per year for gasoline.

In this scenario, you could hypothetically purchase $1,400 worth of United States Gasoline (UGA) and hold on to it for a year. If gasoline prices rise and you end up paying more at the pump, you could also end up making money on your UGA shares.

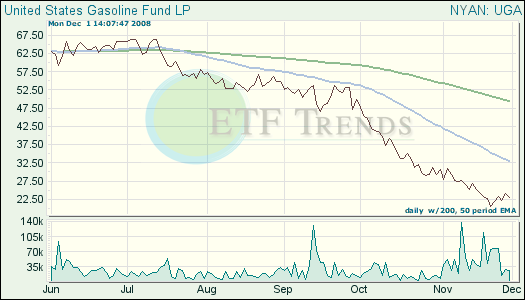

Remember to consider your investment goals and wait until the trends point to entering into the market first before making any decisions. With your strategy in place, consider where you want to hedge your bets when the opportunity strikes. Right now, the trend for gas continues to head south.

- United States Gasoline (UGA), down 54% since its Feb. 28 inception

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.