After the free-fall this year, could it be time to buy commodity exchange traded funds (ETFs) again?

On average, the typical diversified natural resources fund has bombed out on average of 56% this year, taking away any gains made since 2005, says Eric Roseman for MoneyShow.

Commodities, and the funds that tracked them, were the summer of 2008’s little darlings, with oil, base metals and soft commodities in huge demand. The recent losses are tremendous, leaving many investors wondering if this is the time to get back into the sector. Commodities guru Jim Rogers doesn’t think they’re done.

Roseman suggests that if world markets begin to tally and post gains, then commodities will follow due to their need for liquidity.

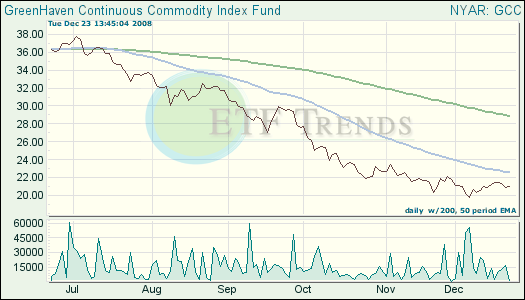

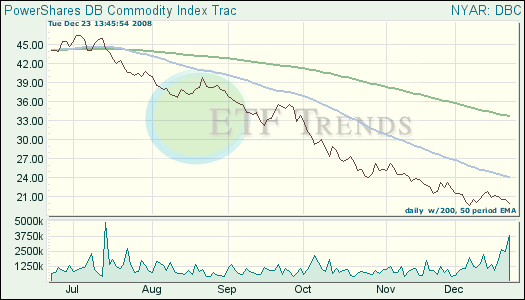

A gradual re-entry into commodities could be on the horizon, set up for the long term. Just be sure to have a strategy in place when you decide to re-enter the market, and watch for the 50 day moving average for a starting point. Right now, the trend for commodities is not there. Wait until it is before considering whether they’re right for you.

- GreenHaven Continuous Commodity Index (GCC): down 31.4% since January 2008 inception

- PowerShares DB Commodity Index Tracking Fund (DBC): down 36.6% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.