Japanese authorities signaled that they may intervene in the currency markets to soften and limit the yen’s appreciation.

What effect will this have on Japanese markets and the exchange traded funds (ETFs) that track these markets?

The yen just recently lost ground on the euro and fell from a 13-year high against the dollar, forcing Japanese Finance Minister Shoichi Nakagawa to watch foreign exchange markets and gear up to make currency moves for monetary policy. The last time Japan intervened in the currency markets, it sold 20.4 trillion in 2003 and 14.8 trillion in 2004, states Terry Woo of Minyanville.

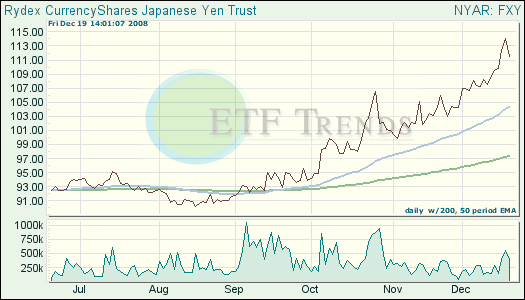

A drop in the yen could be the catalyst to Sony’s (SNE) upside. Sony earns the majority of its revenues outside of Japan, and a weaker Yen results in cheaper Japanese imports. On the flip side, parabolic advances in the yen could lead to significant declines and one may consider the CurrencyShares Japanese Yen Trust ETF (FXY).

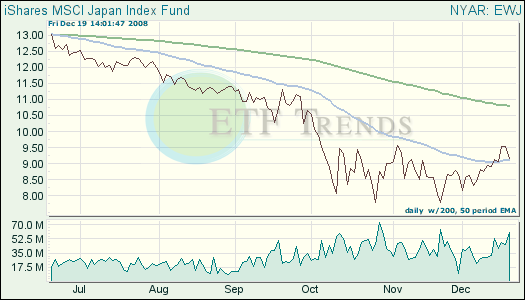

Another ETF that would be worth watching is iShares MSCI Japan Index (EWJ): down 28.5% for the year; Sony makes up 0.1% of the fund’s total assets.

Read the disclaimer, as Tom Lydon is a board member of Rydex Funds.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.