The Cubes exchange traded fund (ETF) is getting socked by downbeat news from the technology sector. Maybe it just needs two turntables and a microphone.

First, Google (GOOG) came out with earnings that were lower than expected. Then Microsoft (MSFT) missed earnings forecasts by a penny. The earnings seemed to signal that our slowing economy was weighing on demand for computer-related products, says Vivek Shankar for Bloomberg.

Google’s slide raises concern that spending is falling in the online advertising market, which they dominate. Microsoft dominates the software industry, where spending seems to have tapered off as well.

Companies that get a majority of their revenue outside the United States, such as Intel (INTC), have fared better. Intel’s earnings reports this week surpassed analyst estimates. Google gets half of its revenue in the United States, while Microsoft gets 60% of its revenue domestically. This strength doesn’t appear to be enough to boost the global technology ETF, however, particularly because Intel is not as strongly weighted in it as Google and Microsoft happen to be.

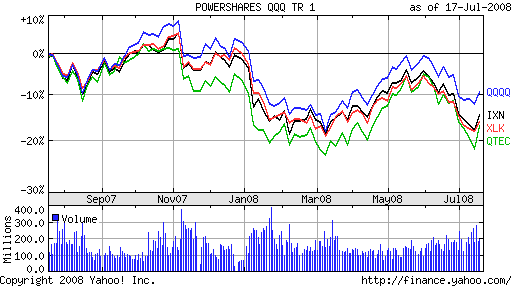

The technology ETFs trading lower on the news include:

- PowerShares QQQ (QQQQ): down 10.8% year-to-date; Google is 4.9%; Intel is 2.7%; Microsoft is 5.2%

- Technology Select Sector SPDR (XLK): down 15.1% year-to-date; Google is 5.5%; Intel is 5.5%; Microsoft is 9.2%

- First Trust Nasdaq-100 Technology Sector Index Fund (QTEC): down 10.1% year-to-date; Google is 2.9%

- iShares S&P Global Technolgy Report (IXN): down 12.4% year-to-date; Google is 4.6%; Intel is 4.7% and Microsoft is 8.3%

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.