Homebuilding exchange traded funds (ETFs) are up sharply in trading this morning after reports that single-family home construction fell while a new law in New York gave a boost to apartments buildings.

Single-family homebuilding lost 5.3% in June to its slowest pace in 17 years, reports Martin Crutsinger for the Associated Press. The last time it was this bad was in January 1991, when the country was in the middle of another housing downturn.

But construction of multifamily units soared a whopping 42.5% after a change in the New York City building codes kicked off a wave of apartment construction. It was enough to offset the losses, and together, single family and apartment home construction rose 9.1%.

But economists cautioned not to get too excited, as the total increase conceals the fact that we’re still in a slump.

Applications for building permits, which are considered a good sign of future activity, rose 11.6%. But that number also was skewed by the jump in the area of apartment construction. Overall, analysts think builders will continue to scale back on construction.

Homebuilder ETFs include:

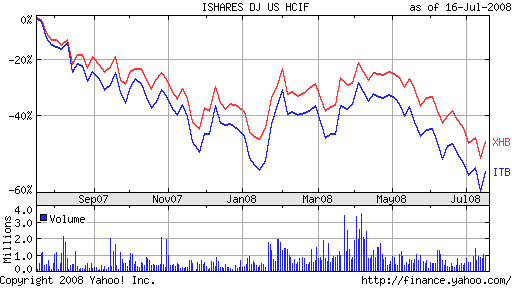

- iShares Dow Jones US Home Construction (ITB), down 20.3% year-to-date

- SPDR S&P Homebuilders (XHB), down 17.5% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.