What does a Fiat have to do with driving your exchange traded fund (ETF) investments?

Italy’s biggest carmaker, Fiat SpA, is closing four of its six auto plants in the country for three weeks between September and November, report Sonia Sirletti and Marco Bertacchi for Bloomberg.

Slumping sales are to blame, and the closures are to affect the factories in Mirafiori, Termini Imerese, Pomigliano and Melfi. Together, these sites employ 22,000 people, or three-quarters of Fiat’s workforce.

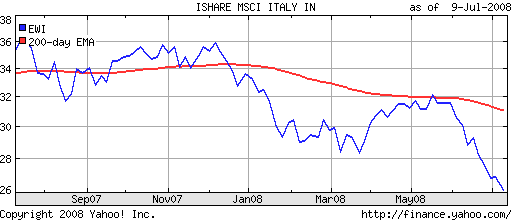

iShares MSCI Italy Index (EWI) holds 2.9% in Fiat (F.MI) and may take the ETF to a fork in the road. Record oil prices and a slowing economy have turned consumers off to buying. Overall auto sales fell 19.5% in June, for the sixth straight month. Fiat fell 6.6%. It’s not good for Italy, which is Europe’s second-largest car market, after Germany.

The economy overall is forecast to stall this year, with a 0.5% rate of expansion. It’s the slowest pace among the 15 countries sharing the euro.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.