Currency exchange traded funds (ETFs) should get a helping hand as the euro rose to new highs against the dollar today.

The drop comes as the markets fret over the latest news from the lending crisis and the overall state of the country’s economy, reports Matt Moore for the Associated Press. The currency that covers 15 nations rose to $1.6038 in European trading, topping the April 22 record of $1.6018.

The dollar rose against the Japanese yen.

The U.S. economy isn’t the only one in the doldrums: German investor confidence sank to its lowest point in 16 years as oil and food prices weighed down the mood. Germany is one of the Eurozone countries.

It’s all prompting concern for companies and politicians in countries that use the euro, because of worries that it will put the brakes on exports as European goods get more expensive for American consumers. German automaker Volkswagen AG is considering locations for a new plant in the United States, while BMW AG has said it will expand production in South Carolina.

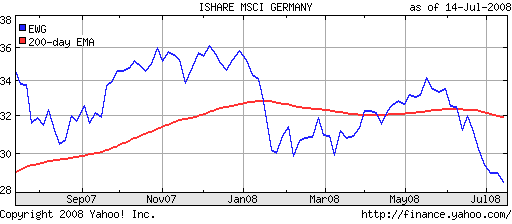

The iShares MSCI Germany (EWG) was trading lower this morning. Volkswagen is 3.7% of the fund, which is down 19.6% year-to-date.

The NETS DAX Index Fund (DAX), which launched on April 9, tracks Germany’s benchmark index. It has 13.7% automotive exposure.

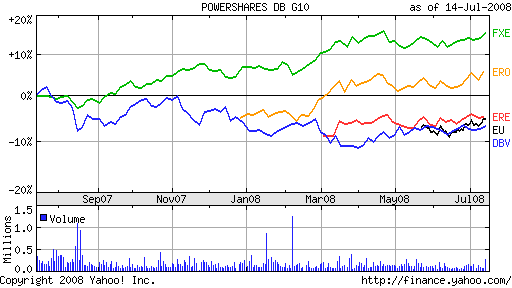

To gain exposure to currencies and hedge the falling dollar against the euro, there are a growing number of funds to choose from, including:

- PowerShares DB G10 Currency Harvest Fund (DBV), down 1% year-to-date

- ELEMENTS Euro (ERE), up 4.4% since March 4 inception

- CurrencyShares Euro Trust (FXE), up 11% year-to-date

- WisdomTree Dreyfus Euro Fund (EU), up 2% since May 22 inception

- iPath EUR/USD Exchange Rate ETN (ERO), up 11% year-to-date

Read the disclosure, as Tom Lydon is a board member of Rydex Funds.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.