The rising demand for coal is helping the commodity’s exchange traded fund (ETF) while weighing on some companies that deal with it.

South Africa’s state-owned power utility company Eskom is experiencing a full-years’ profit-plummet because of the run-up in coal. A report released this week stated that the company was concerned about the security of its future coal supplies, reports Brendan Ryan for Mining MX. If the coal shortage continues and South Africa’s production remains off, the report said that the country could face an annual shortage of 100 million tons by 2017.

Eskom said the full-year profit plummet is as much as 86%, while net income fell $121.4 million, or 923 million rand. The company’s coal consumption was up 5.2%, while fuel prices have tripled.

Carli Lourens for Bloomberg reports that South Africa is suffering a power shortage after the government delayed the country’s utility expansion program. Eskom is set to spend 343 billion rand over the next five years to boost generating capacity 11% to 47,681 megawatts.

Coal prices are forecast to rise further, because of growing demand from China and India, as well as delays in the expansion of coal mines in countries that produce and export the product, reports G. Chandrashekhar for Sify. It could also have something to do with people looking for some kind of fuel that falls under the category of “not gas or oil.”

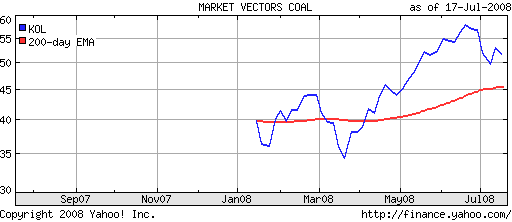

If the predictions come true, Market Vectors Coal (KOL) might benefit. Since its inception on Jan. 15, it’s up 18.9%.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.