It probably was no mystery where the money for all the oil was going as rising prices drained pocketbooks and benefited exchange traded funds (ETFs).

If you were wondering, though, Exxon Mobil (XOM) has solved the mystery by reporting a second-quarter profit of $11.7 billion, the biggest profit from operations ever by a U.S. corporation, reports John Porretto for the Associated Press. But in spite of that, the company’s shares still fell because earnings were off from Wall Street’s expectations.

Revenue was also up 40% from one year ago. Exxon Mobil has been setting lots of records lately: the company also holds the record for the top six most-profitable quarters for a U.S. company, as well as the largest annual profit.

Shell (RDSA.L) also reported a net profit of $11.6 billion for its second quarter, says Toby Sterling for the Associated Press. The numbers make for a 33% year-over-year increase that owes much to high oil prices and a weak dollar. Its selling price of a barrel of oil was $112, up from $64 a year ago, pushing earnings in its production and exploration arm up 90%.

Oil is down in trading today, last seen below $126 a barrel. It’s been driven down by fresh news about continuing weakness in the U.S. economy, reports Pablo Gorondi for the Associated Press. The gross domestic product for the first three months of 2008 was revised downward, to 0.9%.

Just a few weeks ago, crude oil touched on its record high of $147.27.

Among the ETFs that could react to continuing news from the oil sector include:

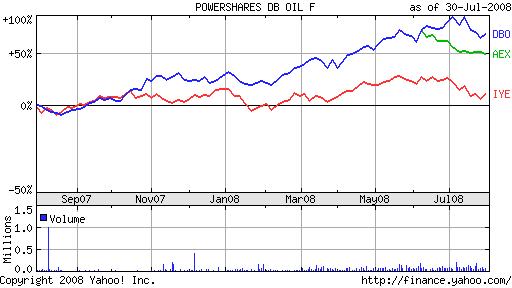

- NETS AEX Index Fund (AEX): launched May 14; Shell is 14.1%

- iShares Dow Jones U.S. Energy (IYE), up 4% year-to-date; Exxon is 23.3%

- PowerShares DB Oil Fund (DBO), up 38.4% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.