China is on everyone’s minds these days as the country gears up for its Olympic Games next week, and many are looking for ways the country’s activity could boost related exchange traded funds (ETFs).

But are tightening rules for businesses hurting them ahead of the games? Anthony Kuhn for NPR says that the government’s rules are giving rise to a new Olympic sport: griping.

The new regulations have given rise to some inconveniences for residents of Beijing: job fairs are canceled, the health ministry has asked hospitals to postpone non-essential procedures to free up medical staffs and there’s a ban on remote-controlled airplanes. A rash of bad press about the rules in other countries has led some to dub them the “No Fun Games.”

The tightening rules have some business owners worried. For example, police are getting strict about closing times, and it’s changed the odds for those who were hoping that an influx of visitors would bring in a windfall.

ETFs that could be affected by restriction include:

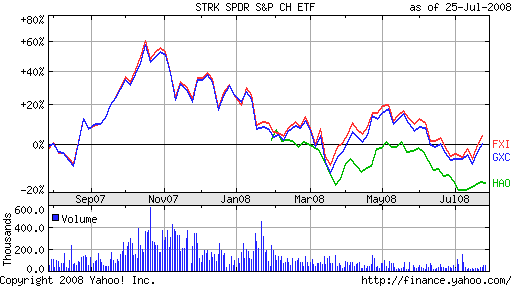

- iShares FTSE/Xinhua China 25 (FXI), down 18.9% year-to-date

- SPDR S&P China (GXC), down 22.8% year-to-date

- Claymore/AlphaShares China Small Cap (HAO), down 17.8% since Jan. 30 inception

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.